Inflation continues to roar in the United States, and interest rates are rising as a result. Because of these challenges, the U.S. economy could tip into a recession next year.

In challenging market climates, investors could consider high-quality dividend stocks such as the Dividend Aristocrats. The Dividend Aristocrats are a group of 65 stocks in the S&P 500 with at least 25 consecutive years of dividend increases.

This article will examine the three best Dividend Aristocrats for total returns.

Target (TGT)

Target (NYSE:TGT) is a retail giant with about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s burgeoning e-commerce business. Target is a Dividend Aristocrat with over 50 years of increases.

The company posted second-quarter earnings on Aug. 16. Adjusted earnings per share (EPS) came in well ahead of estimates at $1.80, which was 38 cents better than expected. Revenue was $24.8 billion, down 4.9% year-over-year and missing estimates by $460 million. The company also sizably lowered its full-year sales and profit expectations due to weakening sales but rising margins. The company said it was seeing continued growth in consumables such as essentials, beauty, food and beverages.

Same-day services grew about 4%, led by 7% growth in Drive-Up. Operating margin was 4.8% of revenue, up from 1.2% a year ago. Gross margin was 27% of sales, up sharply from 21.5%, reflecting lower markdowns and other inventory-related costs, lower freight costs, pricing increases, and lower supply chain and fulfillment costs.

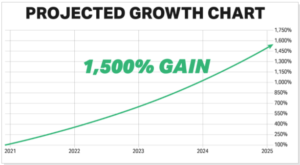

Future growth will be driven by the company’s digital initiatives while EPS will get a boost from share buybacks. The company has $9.7 billion in remaining share repurchase authorizations and did not repurchase any stock in Q2. Target also boosted its dividend by 2 cents per share per quarter.

The dividend payout is now 58% of earnings for this year, which is elevated historically. We expect the payout ratio to decline starting as earnings rise and smaller dividend increases. TGT stock yields 4.1%.

Realty Income (O)

Realty Income (NYSE:O) is a retail real estate investment trust (REIT). Realty Income owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services and entertainment.

In the 2023 second quarter, Realty Income reported net income available to common stockholders of $195.4 million, equivalent to 29 cents per share. Normalized funds from operations (FFO) available to common stockholders was $688.3 million, or $1.02 per share, while adjusted funds from operations (AFFO) available to common stockholders stood at $671.7 million, or $1 per share.

Future growth will be fueled by new properties and redevelopments. The company invested $3.1 billion in 710 properties and properties under development or expansion, yielding an initial weighted average cash lease yield of 6.9%. The company’s net debt to annualized pro forma adjusted EBITDA ratio was 5.3x.

Realty Income generates its growth through growing rents at existing locations, via contracted rent increases or by leasing properties to new tenants at higher rates. It also acquires new properties. Realty Income expects to increase its investments in international markets moving forward. It made a first deal in the U.K. in 2019 and plans to do more such deals in the future when it finds attractive targets.

Realty Income’s most important competitive advantage is its world-class management team that has successfully guided the trust in the past. Management is highly adept at finding attractive investment opportunities while also growing rents from existing properties, which has been very profitable for its shareholders.

Due to the steady growth of Realty Income’s profits, even during the last financial crisis, the dividend looks sustainable, despite the fact that Realty Income pays out around 80% of its FFO to its owners in the form of dividends. Shares currently yield 6.2%.