The $6 AI ‘Wonder Stock' That Could Make You Up To 75X RICHER!

Sponsored

THIS IS A VERY TIME-SENSITIVE OPPORTUNITY.

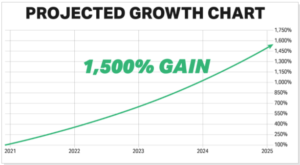

You're so close to knowing the identity of what Ross Givens is calling the “$6 AI Wonder Stock”. This AI-related play could herald the single, biggest tech revolution of the 21st century. In fact, early indications show a $5,000 investment could realistically turn into $75,000… $20,000 could morph into half a million dollars. The WORST thing you could do is to miss out. Reveal the $6 AI ‘Wonder Stock' here.

Dividend Aristocrats are a rare group of stocks. Not only do these members of the S&P 500 pay shareholders a dividend but in order to make the cut, they need to have raised their payout at least yearly for 25 years or more. With thousands of stocks on the market, only a few dozen achieved this status. At last count, there are only 68 Dividend Aristocrats to buy.

But just because a stock made the list doesn’t automatically mean you should buy it. Dividend Aristocrats can and do cut their payouts. Walgreens Boots Alliance (NASDAQ:WBA) did that just last year and was booted from the club. Some analysts believe 3M (NYSE:MMM) may need to cut its dividend too.

Investors also look need to look at whether the payout is sustainable. That usually means whether a company is producing enough free cash flow (FCF) to support the dividend. Those Dividend Aristocrats with the highest growth rates should also produce a rising level of FCF to warrant an investment.

The dividend royalty below have the largest 10-year compounded annual growth rates (CAGR). Let’s see if they also have the cash flows to support those payments.

Lowe’s (LOW)

Home improvement center Lowe’s (NYSE:LOW) reigns supreme among Dividend Aristocrats with the highest growth rates. The retailer’s 10-year CAGR stands at 18.3% an amazing figure for a company that has increased its dividend for over 60 years.

Although some investors might dismiss LOW stock out of hand because of its 1.8% yield they are mistaken for doing so. Because of the dividend growth, payments have increased from just 68 cents a decade ago to $4.30 per share today. That means the yield on cost, or the yield you would enjoy based on the shares you purchased back then, would have skyrocketed as well.

Over the past 10 years the DIY center’s FCF has grown at nearly 10% annually, which is a very healthy rate. It means Lowe’s can readily support its dividend. And as its FCF payout ratio, or the amount of FCF it pays out in dividends, is routinely in the 20% to 30% range, there is lots of room for future growth as well.

Roper Technologies (ROP)

A decade ago, Roper Technologies (NYSE:ROP) was a completely different company. It was primarily a manufacturer of fluid handling equipment, industrial controls and analytical instrumentation. Yet it was increasingly acquiring new businesses that tilted its focus to technology. In 2015, it changed its name from Roper Industries to Roper Technologies. Today, the company is a leader in application software, network software and tech-enabled products, arguably making it one of the most hidden tech stocks around.

Roper’s 10-year dividend CAGR stands at 14.1%. That’s in line with its stated goal of acquiring “niche-focused, asset-light business with leading-edge technologies led by terrific operating leaders that create significant free cash flow to enable further investments for growth.”

And FCF production is impressive at 10% a year for the last 10 years. By being “asset-light,” Roper is able to compound its cash flows into enduring shareholder value. A $10,000 investment in Roper Technologies in 2013 would today be worth $42,580. In comparison, a similar amount put into the S&P 500 would net you just over $33,000.

AbbVie (ABBV)

Pharmaceutical leader AbbVie (NYSE:ABBV) gained entry to the Dividend Aristocrats through the back door. It was spun off from Abbott Labs (NYSE:ABT) almost exactly 10 years ago. Because Abbott was a member of this elite group of stocks, AbbVie was granted admission as well and is given credit for all of its former parent’s dividend history.

Although that seems a suspect way of gaining nobility, AbbVie is proving it is worthy of the title. The pharmaceutical company immediately established its own legacy of dividend increases. For the past decade, AbbVie has hiked the payout by over 14% annually. Even more incredible has been its ability to generate substantial sums of FCF. AbbVie’s 10-year FCF CAGR is also well over 14%. Last year it produced more than $22 billion in FCF while paying out $10.5 billion in dividends. That makes AbbVie’s payout ratio around 50%, fairly consistent with its 10-year history.

Investors can own ABBV stock and rest easy knowing the dividend is safe and will enjoy many more years of future increases.

The “Second Nvidia” Is About to Soar

Sponsored

The artificial intelligence (AI) boom just created one of the biggest companies in the world. I'm talking about Nvidia. The firm is worth more than $1 trillion thanks to this explosion. However, most people don't realize Nvidia just got lucky! Because for most of its history, Nvidia has been focused on an entirely different industry – video games. You see, Nvidia's chips have been designed to serve just one purpose… To create ultrarealistic graphics in games such as Call of Duty and Counter-Strike. In other words… This technology was never meant to power AI. And that's also the reason why Nvidia could soon crash and burn… Because there's a new player in town – one that owns a patent-protected chip specifically designed to run AI on. This makes it much more powerful than Nvidia's gaming tech. I'm talking about a 100x performance boost. The U.S. Air Force, Cisco, and Raytheon are just some of this firm's early elite clients. But soon this chip will be available to the mainstream… And if you position yourself before it reaches the mass market, you could turn every $1 into $120… Just like early Nvidia investors did. Keith just published an urgent presentation on this unique opportunity. Inside, he explains all the details and how you can position yourself today. Get the full story here while there's still time.