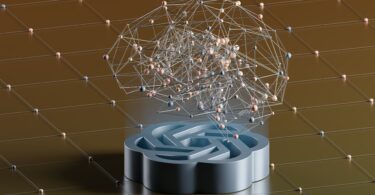

AI “wealth window” will close March 8, 2024?

Sponsored

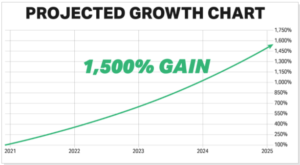

Hello. I'm James Altucher. I've been called a “genius investor” by my fans… And an “eccentric millionaire” by some others. I think it's because I make big predictions… That tend to come true. Today, I'm making my boldest prediction ever. Next-generation AI technology will create the first $100 TRILLION industry. And there could be trillions available to those investors who get in early. I put together this personal video [HERE]… Revealing the AI stocks I believe… Could turn as little as $10,000… Into $1 MILLION over the next few years. If you get in early, this one-time opportunity could… Potentially change your financial circumstances… For you, your family, and your heirs. Today, I want to show you how I believe… AI 2.0 will open a brief “wealth window”… That will slam shut March 8, 2024. If you've missed out on new tech opportunities before…. I urge you, do not ignore this message. HERE is everything you need now.

P.S. To show you I'm serious about helping you get in on this opportunity, I'm giving away one of my top 5 AI 2.0 stock picks – free. See my top 5 picks here.

You have to admire Cathie Wood's ability to make something good out of a bad situation. The Ark Invest co-founder and CEO often adds to some of her favorite positions when they are out of favor. She did it again this week.

Wood spent the first trading day of this week actively buying stocks that recently disappointed investors. She added to her stakes in Roku (ROKU ), 10x Genomics (TXG), and Intellia Therapeutics (NTLA). Let's take a closer look at these three purchases.

-

Roku

It's been a rough run over the past two weeks for Roku. Shares of the streaming video specialist have plummeted 35% over the past nine trading days. Three big events have marked its fall from grace.

The initial hit came on a report that Walmart was in talks to acquire Vizio, a move that would turn a retail partner into a platform competitor.

Roku followed with its own bad news, putting out poorly received fourth-quarter results. Average revenue per user saw a surprising sequential decline.

Walmart would go on to officially announce a $2.3 billion deal to buy Vizio.

It's been tough sledding for a stock that was hitting fresh 52-week highs in December following a blowout quarterly report the month before. Investing is a lot like the TV market, in that you're only as good as your latest season.

Roku remains one of Wood's largest holdings. Even after losing more than a third of its value over the past two weeks, the streaming service stock is her fifth-largest position across all of Ark Invest's holdings.

Roku continues to grow in popularity. There are now 80 million active accounts on the platform, and “active” is the key term there. The average home is now spending more than four hours per day streaming through the Roku operating system. Profitability remains a challenge, but its operating loss narrowed substantially in its latest report. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) turned positive in the second half of last year.

The shares might not rebound right away. Cautious investors may wait for average revenue per user to bounce back or for the Walmart buyout of Vizio to play out. However, Roku continues to have a commanding lead of the connected TV ad revenue being generated from streaming hubs. It's not a bad place to be despite the recent stock swoon.

-

10x Genomics

Another Ark Invest holding that failed to impress the market with its latest quarterly update this month is 10x Genomics. The life sciences specialist, which helps researchers analyze tissue at the individual cell level, posted mixed fourth-quarter results two weeks ago. Revenue may have clocked in just ahead of expectations, but for the fourth time in a row it posted a larger deficit on the bottom line than what Wall Street pros were targeting.

It gets worse. 10x Genomics initiated guidance for 2024, calling for revenue of $670 million to $690 million in the year ahead. After seeing its top line move 20% higher in 2023, the new outlook translates to an 8% to 12% increase. The analyst consensus was hovering around $702 million in revenue. At least three analysts would go on to lower their price targets on 10x Genomics after the uninspiring report and even more problematic guidance.

-

Intellia Therapeutics

Intellia Therapeutics posted disappointing financial results last week. The gene-editing specialist reported a slightly larger-than-expected deficit in its latest quarter. It's not posting meaningful revenue at this point as it works its way through clinical-phase trials for some promising therapies.

Thankfully, the company has a cash-rich balance sheet to see it through this phase of cash burning. Its market cap is $900 million more than its enterprise value. Wood is a big believer in Intellia. She owns more than 10% of the upstart's total shares outstanding.

Not everyone is convinced. Analysts reacted largely unfavorably on Friday after last week's quarterly update. One analyst went on to downgrade the stock while another slashed their price target on the shares.

#1 AI stock trading for $3

Sponsored

AI is by far the biggest tech investing trend of 2024. But Ross Givens says the #1 artificial intelligence stock is NOT Microsoft, Google, Amazon or Apple. Nope – his research is pointing to a tiny, under-the-radar stock that's trading for just $3 right now… And could soon shoot to the moon, handing early investors a windfall. This company already has 98 registered patents for cutting-edge voice and sound recognition technology… And has lined up major partnerships with Honda, Netflix, Pandora, Mercedes Benz and many, many others. So if you missed out on Microsoft when it first went public back in 1986… This could be your shot at redemption. Click here now for the full details of this $3 stock that's set to rocket in the AI revolution…