MicroStrategy Executive Chairman Michael Saylor will present a Bitcoin treasury strategy to the Microsoft Board of Directors before December 10. The revelation came during an X Space organized by investment management firm VanEck, featuring Saylor, Matthew Sigel (Head of Digital Assets Research at VanEck), Jan van Eck (CEO of VanEck), and US Senator Cynthia Lummis.

Matthew Sigel highlighted the upcoming shareholder vote at Microsoft Corporation (NASDAQ: MSFT) that would compel the board to evaluate Bitcoin as a treasury asset. He asked Saylor whether shareholder proposals are effective in promoting Bitcoin adoption as a reserve asset or if there are alternative methods to catalyze greater adoption.

Saylor responded by endorsing shareholder activism as a legitimate approach. He revealed that the activists behind the proposal had contacted him to present to the board. “I agreed to provide a three-minute presentation—that’s all you’re allowed,” he said. Saylor intends to post this presentation online and deliver it to the board of directors.

Related Reading: Insider Leaks Trump ‘Considers’ A Strategic Bitcoin Reserve By Executive Order

He also disclosed that he offered to meet privately with Microsoft CEO Satya Nadella to discuss Bitcoin adoption. However, this offer was not accepted, prompting Saylor to proceed with the formal presentation to the board.

“I also offered to withdraw that proposal if Satya Nadella would meet me. And I said, I would fly to wherever he is and meet him in confidence in his office for an hour to discuss, but we were, that offer was not accepted. So you will see me putting together the three minute proposal for Microsoft and, and it’ll get posted and we’ll send it to the board,” Saylor revealed.

Microsoft has scheduled its annual shareholder meeting for December 10, where an “Assessment of Investing in Bitcoin” will be on the agenda. In a filing with the US Securities and Exchange Commission (SEC) dated October 24, the company included this proposal among the voting items.

Despite the proposal’s inclusion, Microsoft’s Board of Directors has formally recommended that shareholders vote against it. In supplementary materials filed with the SEC on October 25, the board stated that the requested assessment is unnecessary because Microsoft’s management already considers Bitcoin within its broader investment strategy.

Related Reading: Bitcoin Still Has Room To Rise, Quant Explains Why

“Microsoft’s Global Treasury and Investment Services team evaluates a wide range of investable assets to fund ongoing operations, including assets expected to provide diversification and inflation protection,” the filing noted.

During the X Space, Saylor advocated for broader corporate adoption of Bitcoin as a treasury asset, not only at Microsoft but across major corporations with substantial cash reserves. He suggested that similar proposals should be on the agendas of companies like Berkshire Hathaway, Apple, Google, and Meta. “They all have huge hordes of cash. They’re all burning shareholder value,” he remarked.

He argued that integrating Bitcoin into a company’s assets could lead to a more stable and less risky stock. Speaking on Microsoft, Saylor explained: “The approach of Microsoft is 98.5% of the enterprise value is levered to quarterly earnings. And 1.5% of the value of the stock is tangible assets. And it would be a lot more stable stock and a much less risky stock if half the enterprise value of the stock was based upon tangible assets or property like Bitcoin.”

At press time, BTC traded at $92,666.

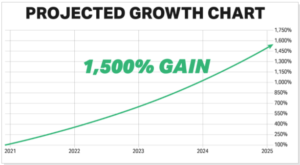

Featured image from YouTube, chart from TradingView.com

MicroStrategy Executive Chairman Michael Saylor will present a Bitcoin treasury strategy to the Microsoft Board of Directors before December 10. The revelation came during an X Space organized by investment management firm VanEck, featuring Saylor, Matthew Sigel (Head of Digital Assets Research at VanEck), Jan van Eck (CEO of VanEck), and US Senator Cynthia Lummis.

Matthew Sigel highlighted the upcoming shareholder vote at Microsoft Corporation (NASDAQ: MSFT) that would compel the board to evaluate Bitcoin as a treasury asset. He asked Saylor whether shareholder proposals are effective in promoting Bitcoin adoption as a reserve asset or if there are alternative methods to catalyze greater adoption.

Saylor responded by endorsing shareholder activism as a legitimate approach. He revealed that the activists behind the proposal had contacted him to present to the board. “I agreed to provide a three-minute presentation—that’s all you’re allowed,” he said. Saylor intends to post this presentation online and deliver it to the board of directors.

Related Reading: Insider Leaks Trump ‘Considers’ A Strategic Bitcoin Reserve By Executive Order

He also disclosed that he offered to meet privately with Microsoft CEO Satya Nadella to discuss Bitcoin adoption. However, this offer was not accepted, prompting Saylor to proceed with the formal presentation to the board.

“I also offered to withdraw that proposal if Satya Nadella would meet me. And I said, I would fly to wherever he is and meet him in confidence in his office for an hour to discuss, but we were, that offer was not accepted. So you will see me putting together the three minute proposal for Microsoft and, and it’ll get posted and we’ll send it to the board,” Saylor revealed.

Microsoft has scheduled its annual shareholder meeting for December 10, where an “Assessment of Investing in Bitcoin” will be on the agenda. In a filing with the US Securities and Exchange Commission (SEC) dated October 24, the company included this proposal among the voting items.

Despite the proposal’s inclusion, Microsoft’s Board of Directors has formally recommended that shareholders vote against it. In supplementary materials filed with the SEC on October 25, the board stated that the requested assessment is unnecessary because Microsoft’s management already considers Bitcoin within its broader investment strategy.

Related Reading: Bitcoin Still Has Room To Rise, Quant Explains Why

“Microsoft’s Global Treasury and Investment Services team evaluates a wide range of investable assets to fund ongoing operations, including assets expected to provide diversification and inflation protection,” the filing noted.

During the X Space, Saylor advocated for broader corporate adoption of Bitcoin as a treasury asset, not only at Microsoft but across major corporations with substantial cash reserves. He suggested that similar proposals should be on the agendas of companies like Berkshire Hathaway, Apple, Google, and Meta. “They all have huge hordes of cash. They’re all burning shareholder value,” he remarked.

He argued that integrating Bitcoin into a company’s assets could lead to a more stable and less risky stock. Speaking on Microsoft, Saylor explained: “The approach of Microsoft is 98.5% of the enterprise value is levered to quarterly earnings. And 1.5% of the value of the stock is tangible assets. And it would be a lot more stable stock and a much less risky stock if half the enterprise value of the stock was based upon tangible assets or property like Bitcoin.”

At press time, BTC traded at $92,666.

Featured image from YouTube, chart from TradingView.com