On-chain data shows the Bitcoin whales have continued to purchase more even at the recent highs, a sign that could be optimistic for the rally.

Bitcoin Large Holders Netflow Has Continued To See Positive Spikes Recently

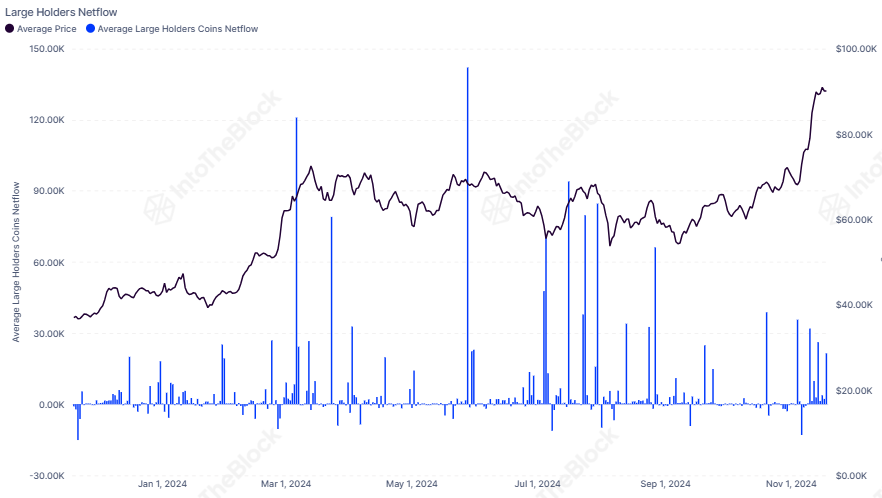

According to data from the market intelligence platform IntoTheBlock, the number of BTC whales has recently increased. The on-chain metric of interest here is the “Large Holders Netflow,” which keeps track of the total amount of Bitcoin flowing into or out of the wallets associated with Large Holders.

IntoTheBlock defines “Large Holders” as investors carrying at least 0.1% of the cryptocurrency’s supply. Today, there are around 19.8 million tokens of the asset in circulation, so holders qualifying for this cohort would be holding at least 19,800 BTC.

Related Reading: Bitcoin Still Has Room To Rise, Quant Explains Why

At the current exchange rate, this amount of the asset is equivalent to about $1.8 billion. Thus, the investors falling in this category would indeed be quite large.

Generally, the influence of any investor in the market goes up the more coins they own, so the Large Holders with their massive balances would contain the most influential entities on the network. As such, the behavior of this cohort can be worth keeping an eye on.

When the Large Holders Netflow has a positive value, these humongous investors observe the inflow of a net amount of coins into their wallets. This buying can naturally be bullish for the asset.

On the other hand, the negative indicator suggests that Large Holders are downsizing their holdings, which can lead to bearish action for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin Large Holders Netflow over the past year:

The metric appears to have witnessed a few green spikes in recent days | Source: IntoTheBlock on X

As the above graph shows, the Bitcoin Large Holders Netflow witnessed massive spikes earlier in the year as the whales had been busy accumulating the asset.

Interestingly, as BTC’s latest run to new all-time highs (ATHs) has occurred, the indicator has again seen positive spikes. The scale of these latest net buys has been considerably smaller than the earlier ones, but the fact that these investors haven’t been selling at all is certainly positive for BTC.

Related Reading: Bitcoin Open Interest Sets Another Record: Wild Week Ahead?

The net accumulation naturally reflects the whales’ confidence in the cryptocurrency right now, considering that the buys have come while BTC has already been trading at higher prices than it ever has in history.

It now remains to be seen whether this Bitcoin Large Holders accumulation would induce a continuation for the run or not.

BTC Price

At the time of writing, Bitcoin is trading at around $92,600, up more than 7% over the last week.

Looks like the price of the coin has been moving sideways over the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

On-chain data shows the Bitcoin whales have continued to purchase more even at the recent highs, a sign that could be optimistic for the rally.

Bitcoin Large Holders Netflow Has Continued To See Positive Spikes Recently

According to data from the market intelligence platform IntoTheBlock, the number of BTC whales has recently increased. The on-chain metric of interest here is the “Large Holders Netflow,” which keeps track of the total amount of Bitcoin flowing into or out of the wallets associated with Large Holders.

IntoTheBlock defines “Large Holders” as investors carrying at least 0.1% of the cryptocurrency’s supply. Today, there are around 19.8 million tokens of the asset in circulation, so holders qualifying for this cohort would be holding at least 19,800 BTC.

Related Reading: Bitcoin Still Has Room To Rise, Quant Explains Why

At the current exchange rate, this amount of the asset is equivalent to about $1.8 billion. Thus, the investors falling in this category would indeed be quite large.

Generally, the influence of any investor in the market goes up the more coins they own, so the Large Holders with their massive balances would contain the most influential entities on the network. As such, the behavior of this cohort can be worth keeping an eye on.

When the Large Holders Netflow has a positive value, these humongous investors observe the inflow of a net amount of coins into their wallets. This buying can naturally be bullish for the asset.

On the other hand, the negative indicator suggests that Large Holders are downsizing their holdings, which can lead to bearish action for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin Large Holders Netflow over the past year:

The metric appears to have witnessed a few green spikes in recent days | Source: IntoTheBlock on X

As the above graph shows, the Bitcoin Large Holders Netflow witnessed massive spikes earlier in the year as the whales had been busy accumulating the asset.

Interestingly, as BTC’s latest run to new all-time highs (ATHs) has occurred, the indicator has again seen positive spikes. The scale of these latest net buys has been considerably smaller than the earlier ones, but the fact that these investors haven’t been selling at all is certainly positive for BTC.

Related Reading: Bitcoin Open Interest Sets Another Record: Wild Week Ahead?

The net accumulation naturally reflects the whales’ confidence in the cryptocurrency right now, considering that the buys have come while BTC has already been trading at higher prices than it ever has in history.

It now remains to be seen whether this Bitcoin Large Holders accumulation would induce a continuation for the run or not.

BTC Price

At the time of writing, Bitcoin is trading at around $92,600, up more than 7% over the last week.

Looks like the price of the coin has been moving sideways over the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com