The “Second Nvidia” Is About to Soar

Sponsored

The artificial intelligence (AI) boom just created one of the biggest companies in the world. I'm talking about Nvidia. The firm is worth more than $1 trillion thanks to this explosion. However, most people don't realize Nvidia just got lucky!Because for most of its history, Nvidia has been focused on an entirely different industry – video games. You see, Nvidia's chips have been designed to serve just one purpose… To create ultrarealistic graphics in games such as Call of Duty and Counter-Strike. In other words… This technology was never meant to power AI. And that's also the reason why Nvidia could soon crash and burn… Because there's a new player in town – one that owns a patent-protected chip specifically designed to run AI on. This makes it much more powerful than Nvidia's gaming tech. I'm talking about a 100x performance boost. The U.S. Air Force, Cisco, and Raytheon are just some of this firm's early elite clients. But soon this chip will be available to the mainstream… And if you position yourself before it reaches the mass market, you could turn every $1 into $120… Just like early Nvidia investors did. Keith just published an urgent presentation on this unique opportunity. Inside, he explains all the details and how you can position yourself today. Get the full story here while there's still time.

by Ross Givens

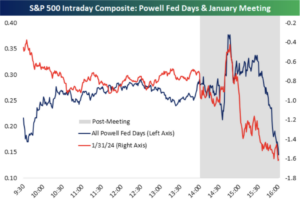

The more Powell spoke, the more markets fell.

Unusual? Far from it. As today’s chart shows, it’s actually par for the course.

Chart of the Day

With Powell at the helm, the market moves down the vast majority of the time during his post-meeting press conferences.

Yesterday was par for the course, with him throwing cold water on the possibility of a March rate cut.

Here was the specific Fed hedging language he used:

“I will tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that.

″It’s probably not the most likely case or what we would call the base case.”

As I said, standard Fed hedging language that still gives them room to cut in March if they want to.

But despite my admittedly frequent jabs at Powell and his big mouth, I’m not mad about yesterday at all.

In fact, there’s an opportunity here most don’t see.

Insight of the Day

When the market gets a little too ahead of itself, a big dip like what we saw yesterday is a chance to pick high-potential stocks for cheaper.

The recent run in the indexes has been great – but also very rare, occurring only a few times in history.

There was just no way it could go on indefinitely. As I say over and over again, stocks do not – and cannot – just keep going up.

Powell’s speech yesterday was the catalyst the market needed to correct itself a little.

The market’s foundations are still solid, meaning yesterday’s downward move is an opportunity to enter the highest-potential stocks at a discount.

Is THIS why Elon Musk Left ChatGPT? (Live Demo!)

Sponsored

Elon Musk co-founded OpenAI, the company behind ChatGPT. Musk later left OpenAI… and created his own independent AI startup. And Elon's AI promises to be 100 times stronger than ChatGPT. Because ChatGPT only works online. While Elon's AI works in the real world. You can see and touch Elon's AI: see the real-life demonstration here. Since ChatGPT has already grown 42 times faster than the internet… The sky's the limit for Elon's AI. Here's the key fact: with Elon's three earlier startups… PayPal… SpaceX… and Tesla… You could've turned $300 into $647,000. Can Elon do it again with his AI startup? See for yourself right here in a shocking 2-minute live demonstration of Elon Musk's AI. Click here to watch the demo.