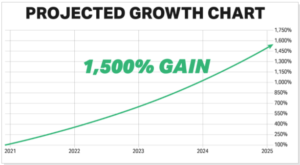

#1 AI stock trading for $6

Sponsored

AI is by far the biggest tech investing trend of 2024. But Ross Givens says the #1 artificial intelligence stock is NOT Microsoft, Google, Amazon or Apple. Nope – his research is pointing to a tiny, under-the-radar stock that's trading for just $6 right now… And could soon shoot to the moon, handing early investors a windfall. This company already has 98 registered patents for cutting-edge voice and sound recognition technology… And has lined up major partnerships with Honda, Netflix, Pandora, Mercedes Benz and many, many others. So if you missed out on Microsoft when it first went public back in 1986… This could be your shot at redemption. Click here now for the full details of this $6 stock that's set to rocket in the AI revolution…

For more than two years now, very little seemed to go right for Medical Properties Trust (MPW). Interest rates soared. Key tenants were on shaky ground. The once-growing dividend was slashed. And the share price plunged.

Unsurprisingly, there's considerable negativity surrounding the healthcare real estate investment trust (REIT) these days. But it's not all doom and gloom. The 13.5%-yielding dividend stock could soar 35% over the next 12 months, according to one analyst.

A big upgrade

BNP Paribas analyst Nate Crossett recently upgraded Medical Properties Trust stock from a “neutral” rating to an “outperform” rating. He also set a 12-month price target of $6, roughly 35% above the current share price.

Crossett isn't the only analyst who thinks the REIT could be ready to rebound somewhat. RBC Capital's Michael Carroll also has an “outperform” rating for the stock. Carroll's price target reflects an upside potential of a little under 13%.

Four other analysts surveyed by LSEG in March recommend buying Medical Properties Trust shares. The average 12-month price target is close to 15% higher than the current share price.

However, there's still some pessimism. Two of the 14 analysts surveyed by LSEG gave Medical Properties Trust an “underperform” rating. Another recommends selling the stock. The remaining five analysts rate the REIT as a hold.

Are things looking up for Medical Properties Trust?

Is Crossett's rosy outlook for Medical Properties Trust warranted? Are things indeed looking up for the beaten-down REIT stock? It's only a maybe at this point.

Medical Properties Trust established a goal to raise at least $2 billion in liquidity in 2024. It has made solid progress so far, announcing in late February the sale of five hospitals to Prime and the sale of a syndicated term loan investment in Median. CEO Ed Aldag said in the company's fourth-quarter conference call that these transactions will raise $480 million. He added that the REIT is “actively working” on several other asset sale opportunities.

Aldag provided an update on Steward, the REIT's largest tenant that has faced significant financial challenges. Medical Properties Trust revealed in January 2024 that it was working with Steward on a plan to bolster its balance sheet and pay unpaid rent as quickly as possible. He said that the REIT is “encouraged by the early progress” in those efforts. When asked by an analyst about the reasons for confidence in Steward's ability to resume paying full rent in June, Aldag replied that the weekly cash flow reports that the hospital operator's advisors submit have exceeded expectations so far.

There was good news related to another beleaguered tenant as well. Aldag stated that Prospect is current on all rent and interest due through January 2024. He also said that the hospital operator's EBITDARM (earnings before interest, taxes, depreciation, amortization, rental costs, and management fees) has risen on a year-over-year basis thanks to higher admission volumes and reimbursement rates from Medi-Cal as well as lower supply costs.

Not out of the woods yet

To be sure, Medical Properties Trust isn't out of the woods yet. Steward's financial issues are still a big problem. There's no guarantee that those issues will be resolved satisfactorily from the REIT's standpoint. Because of the uncertainty related to Steward as well as the timing of future deals to increase liquidity, Medical Properties Trust isn't providing any estimates of full-year 2024 earnings or normalized funds from operations (FFO).

There are also lingering questions about the stability of the dividend. In the Q4 call, Aldag noted that Medical Properties Trust's board of directors “will meet later this quarter to discuss the dividend.”

The hopes of interest rate cuts remain unfulfilled, too. Federal Reserve Chair Jerome Powell said a few days ago that he expected there would be rate cuts on the way later this year. However, he emphasized that no cuts will be made until the Fed is more confident that inflation is moving toward the goal of 2%.

Perhaps Medical Properties Trust will continue paying its juicy dividend at current levels. Maybe BNP Paribas' expectations of a 35% jump in the share price over the next 12 months will be achieved. For now, though, this REIT stock remains in an “iffy” status for all but the most aggressive investors looking for turnaround plays.

One tweet from Elon could blow this story wide open

Sponsored

Take a moment right now and unlock this shocking video. I just saw this from my friend, veteran Trader Tim Bohen. He says this video details a mega trading opportunity right now, that could blow up in the weeks to come.

In fact, he says, just one tweet from Elon Musk could blow this story wide open on or before April 17th. Click here to unlock this video now, before it's too late.