Tiny tech stock could surge by 40X? (Here's how)

Sponsored

Right now, there's a tiny tech stock with a market cap of just about $150 million… But not barely three years ago – it was worth about $6 billion… About 40X where it is today. And right now, my flagship Stealth Tradessystem is telling me this stock could be setting up for a mega breakout higher. If it gets anywhere even close to its 2020 price – you could be in for huge returns… Because remember, going back to its previous price would mean a 4,000% gain… Enough to turn a single $1,000 stake into $40,000…. A $2,500 stake into a retirement-boosting $100,000… And a $10,000 stake into a buy-yourself-a-house $400,000. If you miss out on this, you may remember this for years to come… So, don't allow that to happen. All you have to do to get the details on this potential millionaire-maker tech stock… Is to click here to get a full year of Stealth Trades for just $5 – before it takes off without you. I've put together a FREE report with all the details of this potential millionaire-maker tech stock – plus other high-potential stocks – that could surge as soon as this week. But I'm taking it down very soon… So click here to get this free report before it's too late.

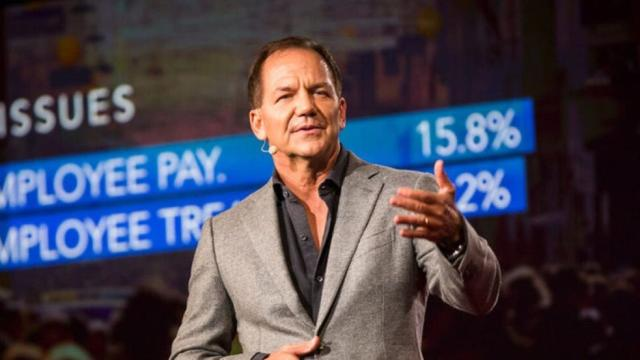

Billionaire philanthropist Paul Tudor Jones is an iconic figure on Wall Street and has been called “one of the pioneers of the modern-day hedge fund industry.” He runs Tudor Investment, the hedge fund he founded in 1980.

His biggest claim to fame was predicting Black Monday, the famed stock market crash of 1987. Less than a year after his call, the market plunged more than 22%, marking the worst single-day decline since the stock market crash of 1929. Jones shorted the market, reaping a 200% gain for his hedge fund. So when Jones talks, Wall Street listens.

The billionaire investor has been quite vocal about the vast potential for artificial intelligence (AI). “I do think the introduction of large language models [and] artificial intelligence is going to create a productivity boom that we've only seen a few times in the last 75 years,” Jones said.

The “Magnificent Seven” stocks all have AI in their DNA, so it isn't surprising that some of these market leaders would be among Tudor's top holdings. Interestingly, however, Jones just slashed his position in Microsoft (NASDAQ: MSFT), cutting its stake by 56%. Here are the AI-centric Magnificent Seven stocks he bought instead.

-

Nvidia

No discussion about AI stocks would be complete without Nvidia (NASDAQ: NVDA), so it isn't surprising that Tudor increased his position in the chipmaker. In the fourth quarter, Tudor Investment boosted its stake in Nvidia by a whopping 810%, increasing its stake to 132,000 shares worth roughly $121 million (as of Thursday's market close). That makes Nvidia its third-largest position, at roughly 1% of the portfolio.

The chipmaker pioneered the graphics processing units (GPUs) that have become the gold standard for processing AI applications. Nvidia dominates the market in both machine learning — an earlier branch of AI — and the data centers where much of the AI processing occurs, boasting an estimated 95% market share in each. Nvidia's long history underpinning AI made it the shoo-in to address the growing demand for generative AI.

Competitors were already scrambling to develop competing processors, but Nvidia cemented its lead last week with the release of its Blackwell architecture. Its flagship AI processor, the GB200 Grace Blackwell Superchip, connects two B200 Tensor Core GPUs with a Grace CPU on a single board, acting as one giant processor. Big tech is already lining up to get its hands on the chips.

In its fiscal 2024 fourth quarter (ended Jan. 28), Nvidia generated record revenue that surged 265% year over year, while its earnings per share (EPS) soared 486% — driven by accelerating demand for its AI processors. Furthermore, given the company's heavy spending on research and development (R&D) and track record of innovation, it will be difficult for rivals to gain ground.

Despite the stock's recent run, Nvidia is still reasonably priced relative to its opportunity. The stock is currently selling for 36 times forward earnings, which is a steal given its triple-digit growth — a fact that likely wasn't lost on Jones.

-

Meta Platforms

Meta Platforms (NASDAQ: META) might not seem the most obvious choice in the AI space, but the company has a long history of using AI to further its business objectives.

In the fourth quarter, Tudor Investment more than doubled its Meta Platforms holdings, increasing its stake to roughly 102,000 shares worth roughly $52 million (as of Thursday's market close). That makes Meta Platforms a top 15 position, at roughly 0.5% of the portfolio.

One of the more intriguing developments over the past year or so has been Meta's foray into large language models. The company developed one of the leading open-source AI models — LLaMA (Large Language Model Meta AI) — which is available on all the major cloud platforms, providing the company with an entirely new revenue stream.

Meta recently announced it is building an AI system that it says significantly improves its video recommendations. A test on Reels resulted in “an 8% to 10% gain in Reels watch time,” according to Facebook chief Tom Alison, which shows the new AI model is “learning from the data much more efficiently than the previous generation.”

The company also introduced a suite of AI-fueled tools to simplify the digital ad process for advertisers on its platform and help them better reach their target market. This will ultimately bolster Meta's fortunes, since the company makes the vast majority of its revenue from digital advertising.

At just 25 times forward earnings, Meta is selling at a discount compared to the S&P 500's valuation of 28 — which likely factored into Tudor's decision.

Smart moves?

While I'm totally on board with Tudor boosting its stakes in Nvidia and Meta Platforms, I must admit to being completely mystified at its decision to cut its stake in Microsoft by half. The company has multiple ways to capitalize on the AI revolution.

First, there's its growing suite of AI-fueled Copilots, which will likely be worth tens or even hundreds of billions of dollars in incremental revenue. Second is the fact that Microsoft Azure is stealing market share from its cloud rivals thanks to its AI efforts. In my mind, those factors make Microsoft a buy, not a sell.

I think Jones made a mistake in cutting its stake in Microsoft, but only time will tell.

Crypto Genius predicts 8,788% return for this coin in the next 5 years…

Sponsored

You might have seen that Bitcoin was one of the best performing assets of 2023. It gained 164%. But a crypto millionaire who has been tracking the space for more than a decade has ABANDONED Bitcoin. He found something better. He predicts it will go up 8,788% in 5 years. He's buying like crazy. And he's giving away the exact name of this cryptocurrency right here: Click here to find out that this 8,788% cryptocurrency is.

P.S. The cryptocurrency is revealed right here on THIS page so make sure to discover what it is while you can.