Bitcoin has set a new all-time high (ATH) beyond the $98,000 level today, as on-chain data shows cryptocurrency inflows have rocketed up.

Crypto Market Capital Inflows Now Sit At Almost $63 Billion Per Month

According to the latest weekly report from the on-chain analytics firm Glassnode, the cryptocurrency sector has been observing the injection of a significant amount of capital recently.

Related Reading: Ethereum A Ticking Bomb? Derivatives Metrics Explode To Record Highs

To calculate the netflows into the sector as a whole, Glassnode has made use of two metrics: Bitcoin + Ethereum Net Position Change and Stablecoin Net Position Change. The first of these keeps track of the net changes happening in the combined Realized Cap of BTC and ETH. The “Realized Cap” is an on-chain capitalization model that considers the last price at which a token was transacted on the blockchain as its ‘real’ value.

Considering that the previous transaction of any coin was likely the last point at which it changed hands, the price at the time would denote its current cost basis. As such, the Realized Cap is essentially a sum of the cost basis of all tokens in the circulating supply.

One way to interpret the model, therefore, is as a measure of the amount of capital that the investors of Bitcoin and Ethereum as a whole have invested into the cryptocurrencies. When the Realized Cap changes, capital flows in or out of these coins. Thus, BTC + ETH Net Position Change, which tracks these changes, reflects the USD netflows happening for the top two assets.

The Stablecoin Net Position Change, the second metric of relevance here, simply measures the capital netflows for the major stablecoins by tracking the changes taking place in their combined supply.

The reason the Realized Cap isn’t required for these assets is that their value remains fixed around the $1 mark; this makes it so that their Realized Cap is always equal to the Market Cap, which in turn is equivalent to the circulating supply with the unit changed.

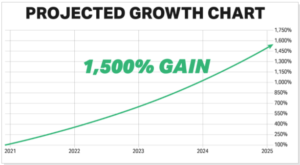

Now, here is the chart published by the analytics firm in the report that shows the trend in the 30-day combined value of the BTC + ETH and Stablecoin Net Position Change over the last few years:

The value of the metric appears to have seen rapid growth in recent weeks | Source: Glassnode's The Week Onchain - Week 47, 2024

From the graph, it’s visible that this combined indicator has witnessed a sharp rise inside the positive territory recently, which implies large net capital inflows into the assets.

Related Reading: Bitcoin Hype Stays Low Despite $94,000 All-Time High, Bullish Sign?

“Over the past 30 days, aggregate inflows have reached a massive $62.9 billion, with Bitcoin and Ethereum networks absorbing $53.3 billion, while stablecoin supplies have expanded by $9.6 billion,” reads the report.

While these inflows don’t represent an exact measurement for the cryptocurrency sector as a whole, they do act as a good approximation as most of the capital that flows into the market does so through Bitcoin, Ethereum, and the stablecoins. It’s only after a rotation from these major assets that the altcoins get their fuel.

Bitcoin Price

Bitcoin had surged close to $98,400 earlier in the day, but its price has since seen a pullback as it’s now down to $97,100.

Looks like the price of the coin has been marching up recently | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Bitcoin has set a new all-time high (ATH) beyond the $98,000 level today, as on-chain data shows cryptocurrency inflows have rocketed up.

Crypto Market Capital Inflows Now Sit At Almost $63 Billion Per Month

According to the latest weekly report from the on-chain analytics firm Glassnode, the cryptocurrency sector has been observing the injection of a significant amount of capital recently.

Related Reading: Ethereum A Ticking Bomb? Derivatives Metrics Explode To Record Highs

To calculate the netflows into the sector as a whole, Glassnode has made use of two metrics: Bitcoin + Ethereum Net Position Change and Stablecoin Net Position Change. The first of these keeps track of the net changes happening in the combined Realized Cap of BTC and ETH. The “Realized Cap” is an on-chain capitalization model that considers the last price at which a token was transacted on the blockchain as its ‘real’ value.

Considering that the previous transaction of any coin was likely the last point at which it changed hands, the price at the time would denote its current cost basis. As such, the Realized Cap is essentially a sum of the cost basis of all tokens in the circulating supply.

One way to interpret the model, therefore, is as a measure of the amount of capital that the investors of Bitcoin and Ethereum as a whole have invested into the cryptocurrencies. When the Realized Cap changes, capital flows in or out of these coins. Thus, BTC + ETH Net Position Change, which tracks these changes, reflects the USD netflows happening for the top two assets.

The Stablecoin Net Position Change, the second metric of relevance here, simply measures the capital netflows for the major stablecoins by tracking the changes taking place in their combined supply.

The reason the Realized Cap isn’t required for these assets is that their value remains fixed around the $1 mark; this makes it so that their Realized Cap is always equal to the Market Cap, which in turn is equivalent to the circulating supply with the unit changed.

Now, here is the chart published by the analytics firm in the report that shows the trend in the 30-day combined value of the BTC + ETH and Stablecoin Net Position Change over the last few years:

The value of the metric appears to have seen rapid growth in recent weeks | Source: Glassnode's The Week Onchain - Week 47, 2024

From the graph, it’s visible that this combined indicator has witnessed a sharp rise inside the positive territory recently, which implies large net capital inflows into the assets.

Related Reading: Bitcoin Hype Stays Low Despite $94,000 All-Time High, Bullish Sign?

“Over the past 30 days, aggregate inflows have reached a massive $62.9 billion, with Bitcoin and Ethereum networks absorbing $53.3 billion, while stablecoin supplies have expanded by $9.6 billion,” reads the report.

While these inflows don’t represent an exact measurement for the cryptocurrency sector as a whole, they do act as a good approximation as most of the capital that flows into the market does so through Bitcoin, Ethereum, and the stablecoins. It’s only after a rotation from these major assets that the altcoins get their fuel.

Bitcoin Price

Bitcoin had surged close to $98,400 earlier in the day, but its price has since seen a pullback as it’s now down to $97,100.

Looks like the price of the coin has been marching up recently | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com