Data shows the Bitcoin Open Interest has reached yet another all-time high (ATH), a sign that more volatility could be coming for BTC.

Bitcoin Open Interest Has Reached A Fresh High Recently

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the BTC Open Interest has shot up recently. The “Open Interest” here refers to a metric that keeps track of the total amount of derivatives positions related to Bitcoin that are currently open on all exchanges.

When the value of this indicator goes up, it means the derivatives users are opening up fresh positions on the market. Generally, the overall leverage in the sector rises when this happens, so an increase in the Open Interest can lead to more volatility in the asset’s price.

On the other hand, the metric registering a decline suggests the investors either are closing positions of their own will or are getting liquidated by their platform. The cryptocurrency may become more stable following this trend, due to the reduced leverage.

Related Reading: PEPE Breaks Another Record: Active Users Smash 20,500

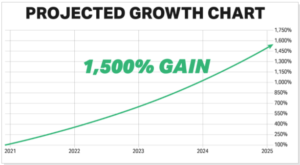

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the last few months:

The value of the metric appears to have been heading up in recent weeks | Source: @JA_Maartun on X

As displayed in the above graph, the Bitcoin Open Interest has been following an uptrend over the last few months, but recently, the indicator’s rise has been particularly sharp.

This rapid growth in the indicator, in which it has been setting record after record, has coincided with BTC’s explosive rally to new all-time highs (ATHs). The development isn’t anything unusual, as periods of sharp price action tend to attract a lot of attention, and with such interest naturally comes speculation on exchanges.

The scale of the increase that the indicator has seen, however, could be something concerning. Historically, whenever the Open Interest has risen too high, a mass liquidation event (popularly known as a squeeze) has generally followed. In such events, a swing in the price liquidates a large amount of overleveraged positions at once, kicking off a sort of feedback cycle where the liquidations amplify the price move and cause even more liquidations.

Related Reading: Bitcoin ‘Trader’ Profits Balloon To 47%: Here’s How They Looked Last Top

In theory, the volatility emerging out of a squeeze can take the cryptocurrency in either direction, but in bullish periods, an overheated derivatives market usually unravels in a correction for BTC, as long positions tend to accumulate when the price rallies.

During the last few days, the Open Interest had seen a bit off a cooldown, but it seems speculators have returned to start the new week as the metric has just witnessed another leg up. It now remains to be seen how Bitcoin would develop in the coming days and if another squeeze would take place.

BTC Price

At the time of writing, Bitcoin is trading at around $90,500, up almost 10% over the last week.

Looks like the price of the coin has been consolidating in the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Data shows the Bitcoin Open Interest has reached yet another all-time high (ATH), a sign that more volatility could be coming for BTC.

Bitcoin Open Interest Has Reached A Fresh High Recently

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the BTC Open Interest has shot up recently. The “Open Interest” here refers to a metric that keeps track of the total amount of derivatives positions related to Bitcoin that are currently open on all exchanges.

When the value of this indicator goes up, it means the derivatives users are opening up fresh positions on the market. Generally, the overall leverage in the sector rises when this happens, so an increase in the Open Interest can lead to more volatility in the asset’s price.

On the other hand, the metric registering a decline suggests the investors either are closing positions of their own will or are getting liquidated by their platform. The cryptocurrency may become more stable following this trend, due to the reduced leverage.

Related Reading: PEPE Breaks Another Record: Active Users Smash 20,500

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the last few months:

The value of the metric appears to have been heading up in recent weeks | Source: @JA_Maartun on X

As displayed in the above graph, the Bitcoin Open Interest has been following an uptrend over the last few months, but recently, the indicator’s rise has been particularly sharp.

This rapid growth in the indicator, in which it has been setting record after record, has coincided with BTC’s explosive rally to new all-time highs (ATHs). The development isn’t anything unusual, as periods of sharp price action tend to attract a lot of attention, and with such interest naturally comes speculation on exchanges.

The scale of the increase that the indicator has seen, however, could be something concerning. Historically, whenever the Open Interest has risen too high, a mass liquidation event (popularly known as a squeeze) has generally followed. In such events, a swing in the price liquidates a large amount of overleveraged positions at once, kicking off a sort of feedback cycle where the liquidations amplify the price move and cause even more liquidations.

Related Reading: Bitcoin ‘Trader’ Profits Balloon To 47%: Here’s How They Looked Last Top

In theory, the volatility emerging out of a squeeze can take the cryptocurrency in either direction, but in bullish periods, an overheated derivatives market usually unravels in a correction for BTC, as long positions tend to accumulate when the price rallies.

During the last few days, the Open Interest had seen a bit off a cooldown, but it seems speculators have returned to start the new week as the metric has just witnessed another leg up. It now remains to be seen how Bitcoin would develop in the coming days and if another squeeze would take place.

BTC Price

At the time of writing, Bitcoin is trading at around $90,500, up almost 10% over the last week.

Looks like the price of the coin has been consolidating in the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com