With President-elect Donald Trump’s recent commitment to using Bitcoin as a strategic reserve asset for the United States, speculation regarding the timing and feasibility of this initiative has intensified within the crypto industry.

This proposal, first articulated during the 2024 National Bitcoin Conference in Nashville earlier this year by Trump and pro-crypto Senator Cynthia Lummis, has garnered significant attention as major financial players weigh in on its potential implications.

Race To Implement Strategic Bitcoin Reserve

Notably, BlackRock, the world’s largest asset manager and a leading issuer of cryptocurrency exchange-traded funds (ETFs), has reportedly expressed support for establishing a strategic Bitcoin reserve.

As revealed by Trump’s previous statements and Senator Lummis’ bill, this initiative aims to address the country’s staggering national debt, currently estimated at $36 trillion, by leveraging BTC’s unique attributes as a digital asset.

Related Reading: Trump’s Private Meeting With Coinbase CEO Brian Armstrong: What’s On The Agenda?

Dennis Porter, co-founder and CEO of the non-profit organization Satoshi Action Fund (SAF), confirmed BlackRock’s endorsement of the strategic Bitcoin reserve, while emphasizing that Trump’s administration is actively pursuing the creation of this reserve through an executive order.

Porter has indicated that his discussions with US Senate offices reveal significant backing for this plan, stating, “Game on, President Trump. The race is on.” He highlighted the situation’s urgency, suggesting that Trump’s team is motivated to act swiftly to implement the reserve before any state can adopt similar legislation.

New BTC Legislation Ahead Of Trump’s Inauguration?

Porter further noted that he is racing to pass the strategic Bitcoin reserve legislation at the state level, potentially ahead of any federal executive order, underscored by his confidence that such laws could be enacted within days of Trump assuming office.

Interestingly, Trump’s proposal has found resonance outside the US, with Porter revealing that he has been invited to speak to members of Congress and parliament in two different countries, one in Europe and another in Latin America, about establishing a similar strategic Bitcoin reserve.

In parallel with these developments, BlackRock released a report indicating a renewed optimism surrounding regulatory clarity for Bitcoin and digital assets, particularly following the recent US elections.

Related Reading: Bitcoin And Ethereum Now Treasury Reserves For International Healthcare Group Cosmos

The report suggests that Trump’s campaign commitment to a strategic Bitcoin reserve, alongside the electoral success of pro-crypto politicians in both the House and Senate, could create a favorable macroeconomic environment for Bitcoin’s adoption.

Robbie Mitchnick, Head of Digital Assets at BlackRock, highlighted that while Bitcoin’s long-term adoption will largely be driven by its fundamental use case as a global monetary alternative, other factors, such as declining real interest rates, may also be catalysts for its increased acceptance.

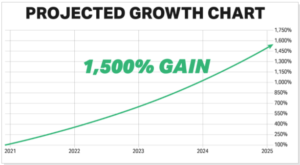

When writing, BTC was trading at $92,330, approaching its all-time high of $93,300 reached during last week’s bullish trend.

Featured image from DALL-E, chart from TradingView.com

With President-elect Donald Trump’s recent commitment to using Bitcoin as a strategic reserve asset for the United States, speculation regarding the timing and feasibility of this initiative has intensified within the crypto industry.

This proposal, first articulated during the 2024 National Bitcoin Conference in Nashville earlier this year by Trump and pro-crypto Senator Cynthia Lummis, has garnered significant attention as major financial players weigh in on its potential implications.

Race To Implement Strategic Bitcoin Reserve

Notably, BlackRock, the world’s largest asset manager and a leading issuer of cryptocurrency exchange-traded funds (ETFs), has reportedly expressed support for establishing a strategic Bitcoin reserve.

As revealed by Trump’s previous statements and Senator Lummis’ bill, this initiative aims to address the country’s staggering national debt, currently estimated at $36 trillion, by leveraging BTC’s unique attributes as a digital asset.

Related Reading: Trump’s Private Meeting With Coinbase CEO Brian Armstrong: What’s On The Agenda?

Dennis Porter, co-founder and CEO of the non-profit organization Satoshi Action Fund (SAF), confirmed BlackRock’s endorsement of the strategic Bitcoin reserve, while emphasizing that Trump’s administration is actively pursuing the creation of this reserve through an executive order.

Porter has indicated that his discussions with US Senate offices reveal significant backing for this plan, stating, “Game on, President Trump. The race is on.” He highlighted the situation’s urgency, suggesting that Trump’s team is motivated to act swiftly to implement the reserve before any state can adopt similar legislation.

New BTC Legislation Ahead Of Trump’s Inauguration?

Porter further noted that he is racing to pass the strategic Bitcoin reserve legislation at the state level, potentially ahead of any federal executive order, underscored by his confidence that such laws could be enacted within days of Trump assuming office.

Interestingly, Trump’s proposal has found resonance outside the US, with Porter revealing that he has been invited to speak to members of Congress and parliament in two different countries, one in Europe and another in Latin America, about establishing a similar strategic Bitcoin reserve.

In parallel with these developments, BlackRock released a report indicating a renewed optimism surrounding regulatory clarity for Bitcoin and digital assets, particularly following the recent US elections.

Related Reading: Bitcoin And Ethereum Now Treasury Reserves For International Healthcare Group Cosmos

The report suggests that Trump’s campaign commitment to a strategic Bitcoin reserve, alongside the electoral success of pro-crypto politicians in both the House and Senate, could create a favorable macroeconomic environment for Bitcoin’s adoption.

Robbie Mitchnick, Head of Digital Assets at BlackRock, highlighted that while Bitcoin’s long-term adoption will largely be driven by its fundamental use case as a global monetary alternative, other factors, such as declining real interest rates, may also be catalysts for its increased acceptance.

When writing, BTC was trading at $92,330, approaching its all-time high of $93,300 reached during last week’s bullish trend.

Featured image from DALL-E, chart from TradingView.com