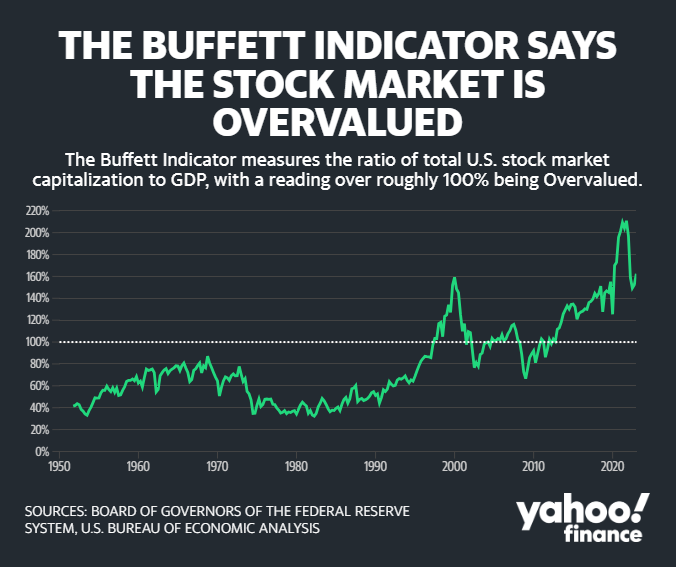

Warren Buffett's favorite stock market indicator is hinting that equity valuations are stretched after a summer of bull market vibes on Wall Street.

The “Buffett Indicator,” as it’s known by devoted followers of the Oracle of Omaha, is now sitting at “significantly overvalued” levels. The indicator takes the Wilshire 5000 Index (viewed as the total stock market) and divides it by the annual US GDP.

Picking apart the numbers, the Buffett Indicator stands at about 170.2% — up a sharp 22% from the Sept. 2022 lows, per data from GuruFocus. The indicator has climbed steadily from the first official day of summer on June 21.

“The stock market is significantly overvalued according to the Buffett Indicator,” researchers at GuruFocus said. “Based on the historical ratio of total market cap over GDP (currently at 170.2%), it is likely to return 1% a year from this level of valuation, including dividends.”

The Buffett Indicator rose to fame following a 2001 Fortune Magazine article written by Buffett and longtime Fortune writer and Buffett insider Carol Loomis.

“The ratio has certain limitations in telling you what you need to know,” Buffett explained in the article. “Still, it is probably the best single measure of where valuations stand at any given moment.”

The S&P 500 has shot up nearly 17% on the year as major companies have posted solid earnings and shrugged off nagging inflation and uneven economic growth rates. Analysts in turn have scrambled to upwardly revise their profit forecasts on companies, supporting higher stock prices.

Buffett's own Berkshire Hathaway posted its highest-ever quarterly profit in the second quarter at an astounding $36 billion, and Berkshire stock promptly hit a record high earlier this week.

Meanwhile, US consumers continue to hold up well and splurge on everything from Marriott (MAR) hotel stays overseas to domestic travel experiences on Airbnb (ABNB).

“I'm really not surprised by the resilience of the US consumer,” Marriott CFO Leeny Oberg told Yahoo Finance Live.

Outside of the S&P 500, stocks with exposure to the booming generative AI movement have lifted overall market sentiment and the Nasdaq Composite.

For example, Nvidia (NVDA) and Meta (META) are up 194% and 156% year to date, respectively. The Nasdaq has surged 31%.

But valuations on stocks are starting to come back into focus — as they should, given where indicators such as the Buffett Indicator are situated.

Recent work from Truist co-chief investment officer Keith Lerner reveals that valuations have reached some of the “richest levels seen in past few decades.”

Lerner adopted a Neutral stance on stocks in large part because of elevated valuations.

Other big names on the Street are just downright bearish too, which is beginning to weigh on markets.

“With soft landing having become the dominant market narrative, recession risk has been largely priced out from risk assets, apart from in commodities,” top JP Morgan strategist Marko Kolanovic wrote in a note on Wednesday. “In fact, in our view, equity valuations are pricing in an even more optimistic scenario than a soft landing — akin to a continued expansion (no landing) and simultaneous monetary easing.”

“With developed market central banks unlikely to ease near-term, ongoing quantitative tightening and our base case for macroeconomic slowdown, multiples look too high,” the strategist added.

Kolanovic recommended investors underweight stocks here, a fancy way of signaling equities could relatively lag moving forward.

The Buffett Indicator throws off that same viewpoint.