Earning interest is not – repeat, not – why you hold cash.

Whenever markets get like they are now, everyone loves to talk cash – cash on hand, cash coming off the sidelines, going to cash, cash, cash, cash. Watch any financial news show on cable, and it won’t be long before you hear it mentioned.

This is one of the funniest discussions I think I have ever heard. That it’s even up for debate is pretty ridiculous, but I guess they have to fill airtime with something.

Particularly dumb is the chin-wagging about the “low returns” on cash these days.

The return on cash is minimal, I agree, and for sure it’s more comfortable to hold cash when you’re collecting a nice interest payment, but earning interest is not – repeat, not – why you hold cash.

How much interest does a carpenter earn on his hammer? None, of course… but he can sure make a big pile of cash putting the hammer to work.

It works the same way with stocks. Cash is a tool – an essential tool – for investors.

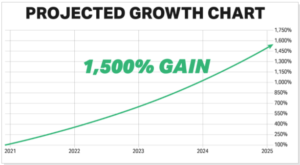

Having cash means you can quickly and easily take advantage of bad markets or jump on “fallen angel” opportunities that come along from time to time. Being able to do that at will is the difference between doing okay as an investor and doing really freaking fantastic as an investor.

So that leaves us with two questions: “How much cash should I have in my portfolio, and what should I do with it?”

Those are big questions that investors have grappled with for years. I’m going to show you the answers.

Not only are they simpler than anyone realizes, but they’re the key to maximum wealth…

[Read Next:] 6 Simple Steps to Potentially Thousands in “Rent Checks”

Here’s the Cash Secret of the World’s Best Investors

The seemingly elusive answers to these questions… are actually in the market itself, provided you’re using strict “Heatseekers” criteria to target great companies at unreasonably cheap prices.

Here’s what I mean by that.

If the stocks in your portfolio are getting pricey and you can’t find any new bargains to replace them, then that’s a flashing neon sign that now’s a good time to hold lots of cash.

Why? When valuations get sky-high and cease to make any kind of sense, the scenario never ends well for the markets.

Sure, we don’t know exactly when bad things will happen to a richly overvalued market, but we do know it’s likely due to a fall.

On the other hand, when the market starts to look like an all-you-can-eat buffet and there are more good companies at great prices than you can afford, we are probably near a market bottom.

This is when you spend the cash.

Are the world’s best companies selling at single-digit price/earnings ratios? Spend the cash.

Are banks you judge to have fortress-like balance sheets trading at insane discounts from their asset value? Spend the cash.

Can you see any office buildings, apartments, high-end malls, or other properties going for 40% off their resale value? Spent the cash – on REITs.

Critical — Public Law 92-313 Paves the Way for “Federal Rent Checks”

It’s not always easy to sit tight while other investors are spending like sailors on shore leave, buying up exciting-but-too-expensive stocks left and right, but in the end, you will enjoy the bigger, fatter returns while everyone else nurses their hangovers.

Not only will you be rich, but you’ll be in great company…

These People Used a Simple Cash Strategy

As Charlie Munger once pointed out, “It takes character to sit there with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities.”

And as Munger’s better-known partner Warren Buffett once put it, “Cash combined with courage in a time of crisis is priceless.”

Some of the most outrageously successful investors you’ve never heard of have used elegant, deadly effective cash strategies to achieve that success.

Like Hetty Green…

Right around the turn of the 20th century, Green was almost certainly the richest woman in the United States – probably even the world’s richest woman not named “Queen Victoria.”

Green’s formula was simple. When times were good, she kept her money in the bank, made first mortgage loans on high-quality properties, and was generally very conservative.

But when things were bad and stocks and real estate prices were collapsing, she would be the only one around with the cash reserves to snap up property and companies on the cheap.

A few years later, when the world had recovered as it always does, she would just sell them at several multiples of her purchase price and adopt a cash-heavy, conservative posture again.

There’s Seth Klarman, too.

Klarman runs the Baupost Fund; he’s been one of the top-performing hedge fund managers in the world, returning around 20% a year for more than 35 years now.

He accomplished this by always having lots of cash on hand, to act like Hetty Green when prices were falling.

Klarman wrote in a shareholder letter: “Our willingness to hold cash at times when great opportunities are scarce allows us to take advantage of opportunity amidst turmoil that could handcuff a competitor who is always fully invested.”

An investor without cash is like a carpenter without a hammer or a surgeon without a scalpel.

So, yes, you should have cash. If bargains are hard to find and prices have been moving up for an extended period of time, you should have lots of cash. If bargains are thick on the ground, like the diamond truck tipped over and spilled all over the interstate, that’s when you spend the cash.

I know that would seem to fly in the face of all the investment advice we have received over the years, but keep something in mind: Most of that “advice” emanated from Wall Street, and Wall Street hates cash, mostly because they haven’t figured out how to charge fees on it.

“Damn the torpedoes, full speed (and full investment) ahead” has long been Wall Street’s approach to getting your money into their pockets.

If you want average returns (or maybe even average losses), then by all means, take all of your money and buy stock indexes.

But to get rich – “Heatseeker rich” – use a cash strategy like the one I just showed you. Cash is a tool, and it is the most important one in the box.

Leave a Comment