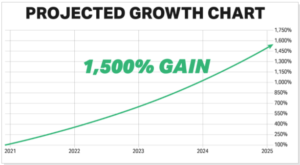

The global cryptocurrency market continues to attract significant investor interest as crypto investment products recorded a substantial influx of funds last week.

According to CoinShares’ latest weekly report, crypto funds registered a net inflow of $2.19 billion globally, bringing year-to-date (YTD) net inflows to a record high of $33.5 billion.

The surge in inflows coincided with Bitcoin’s recent rally to a new all-time high of $93,477, which contributed to CoinShare’s total assets under management (AUM) for crypto funds reaching roughly $138 billion.

Related Reading: Strategic Bitcoin Reserve Plan Unveiled By Polish Presidential Contender

Global Distribution Of Crypto Inflows And Key Trends

US-based funds primarily drove the inflows, accounting for $2.21 billion of the total weekly inflow. Other regions, including Hong Kong, Australia, and Canada, contributed net inflows of $27 million, $18 million, and $13 million, respectively.

On the other hand, investors in Sweden and Germany opted to take profits, resulting in regional net outflows of $58 million and $6.8 million, respectively. Meanwhile. Bitcoin-based products continued to dominate the market, attracting $1.48 billion in net inflows globally over the week.

The renewed interest in Bitcoin coincided with its price surge but also spurred a notable increase in short-Bitcoin investment products, which received $49 million in new investments. This development reflects investor skepticism or hedging against potential price pullbacks following the recent highs.

Ethereum-based products, which have faced challenges in recent months, showed signs of recovery by registering net inflows of $646 million globally.

CoinShares Head of Research James Butterfill highlighted that the turnaround might have been influenced by a mix of market factors, including a proposed network upgrade dubbed the Beam Chain by Ethereum researcher Justin Drake and market optimism driven by the US elections. Ethereum inflows represented 5% of the asset’s total AUM, indicating renewed investor confidence.

Behind The Surge

Just as the inflow seen in Ettherum, Butterfill also noted that the overall spike in crypto fund inflows last week appears to be driven by a mix of market factors, including a shift in US monetary policy and the impact of the Republican party’s sweeping victory in the US elections.

Butterfill further revealed that although the week began with $3 billion in net inflows over the first few days, a subsequent $866 million outflows was observed following Bitcoin’s all-time high (ATH).

Related Reading: Elon Musk, RFK Jr. Support Pro-Bitcoin Howard Lutnick For Treasury Secretary

Speaking of BTC’s ATH, following the achievement of the peak above $93,000 on November 13, BTC has seen a noticeable correction in price.

So far, Bitcoin has dropped by 2.8% from this ATH of $93,477 as it currently trades for $90,334 at the time of writing albeit up slightly by 0.2% in the past day.

Interestingly, over the past few days since BTC started this correction, its daily trading volume has also seen quite a significant drop in valuation dropping from above $70 billion last week to $59 billion today.

Featured image created with DALL-E, Chart from TradingView

The global cryptocurrency market continues to attract significant investor interest as crypto investment products recorded a substantial influx of funds last week.

According to CoinShares’ latest weekly report, crypto funds registered a net inflow of $2.19 billion globally, bringing year-to-date (YTD) net inflows to a record high of $33.5 billion.

The surge in inflows coincided with Bitcoin’s recent rally to a new all-time high of $93,477, which contributed to CoinShare’s total assets under management (AUM) for crypto funds reaching roughly $138 billion.

Related Reading: Strategic Bitcoin Reserve Plan Unveiled By Polish Presidential Contender

Global Distribution Of Crypto Inflows And Key Trends

US-based funds primarily drove the inflows, accounting for $2.21 billion of the total weekly inflow. Other regions, including Hong Kong, Australia, and Canada, contributed net inflows of $27 million, $18 million, and $13 million, respectively.

On the other hand, investors in Sweden and Germany opted to take profits, resulting in regional net outflows of $58 million and $6.8 million, respectively. Meanwhile. Bitcoin-based products continued to dominate the market, attracting $1.48 billion in net inflows globally over the week.

The renewed interest in Bitcoin coincided with its price surge but also spurred a notable increase in short-Bitcoin investment products, which received $49 million in new investments. This development reflects investor skepticism or hedging against potential price pullbacks following the recent highs.

Ethereum-based products, which have faced challenges in recent months, showed signs of recovery by registering net inflows of $646 million globally.

CoinShares Head of Research James Butterfill highlighted that the turnaround might have been influenced by a mix of market factors, including a proposed network upgrade dubbed the Beam Chain by Ethereum researcher Justin Drake and market optimism driven by the US elections. Ethereum inflows represented 5% of the asset’s total AUM, indicating renewed investor confidence.

Behind The Surge

Just as the inflow seen in Ettherum, Butterfill also noted that the overall spike in crypto fund inflows last week appears to be driven by a mix of market factors, including a shift in US monetary policy and the impact of the Republican party’s sweeping victory in the US elections.

Butterfill further revealed that although the week began with $3 billion in net inflows over the first few days, a subsequent $866 million outflows was observed following Bitcoin’s all-time high (ATH).

Related Reading: Elon Musk, RFK Jr. Support Pro-Bitcoin Howard Lutnick For Treasury Secretary

Speaking of BTC’s ATH, following the achievement of the peak above $93,000 on November 13, BTC has seen a noticeable correction in price.

So far, Bitcoin has dropped by 2.8% from this ATH of $93,477 as it currently trades for $90,334 at the time of writing albeit up slightly by 0.2% in the past day.

Interestingly, over the past few days since BTC started this correction, its daily trading volume has also seen quite a significant drop in valuation dropping from above $70 billion last week to $59 billion today.

Featured image created with DALL-E, Chart from TradingView