Nepal’s Financial Intelligence Unit (FIU), in its Strategic Analysis Report 2024, revealed that the country’s blanket ban on crypto trading has become a significant obstacle for fraud victims seeking to report their cases to authorities.

Digital Asset Ecosystem In Nepal At A Glance

The FIU is a division of Nepal Rastra Bank, the country’s central bank. It monitors and reports suspicious transactions, particularly those linked to illicit activities such as money laundering and terrorism financing.

Related Reading: Nepal Issues Warning; Shuts Access To Crypto Gambling And Other Apps

The report highlighted an increase in fraudsters using techniques like “smurfing,” where large transactions are divided into smaller amounts to avoid detection. Additionally, these fraudsters convert illicit funds into digital currencies, making it harder for authorities to trace or freeze the assets.

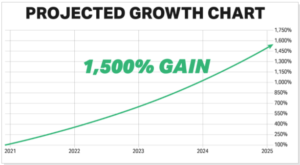

The FIU further emphasized that many individuals are deceived into investing in digital assets with promises of extraordinary returns. The report noted:

The advertisements direct the potential prey to deposit amount in certain bank accounts or wallet accounts. The amount thus deposited is later not returned as promised. In countries like Nepal where investment in virtual assets like cryptocurrency is illegal, the victims rarely come up with complaints against such scams for potential repercussions.

Nepal banned digital asset trading and mining in September 2021. Subsequently, in January 2023, the Nepalese Telecommunications Authority ordered internet service providers (ISPs) to block access to all crypto-related websites, including trading platforms.

Social media and online advertisements are key channels through which fraudsters lure unsuspecting victims into fake digital asset investment schemes. However, the illegal status of digital asset trading in Nepal has discouraged victims from reporting these incidents to law enforcement, further enabling scammers.

The FIU has called for stricter oversight of crypto transactions in the country to curb these fraudulent activities. The report also underscored the importance of increasing public awareness, fostering inter-departmental cooperation, and creating a balanced regulatory framework to address crypto-related fraud more effectively.

Crypto Regulations In South Asia

Nepal is one of the few countries, alongside China, Russia, Iran, Bangladesh, and others, to ban all digital asset trading activity. However, other South Asian countries have adopted varying approaches toward digital assets.

Related Reading: India Cracks Down On Crypto: Regulators Favor CBDC In Push Vs. Bitcoin & Co.

For instance, digital asset trading is not outright banned in India. However, the country has imposed high tax on profits arising from crypto trades, without the option of using losses to minimize potential tax liabilities.

In contrast, Pakistan recently took a significant regulatory turn by legalizing virtual assets, a radical departure from its earlier anti-crypto stance. However, analysts believe this policy shift primarily aims to introduce a central bank digital currency (CBDC) rather than fully embracing decentralized cryptocurrencies.

Bhutan is perhaps the most pro-crypto country in the region. The nation’s total BTC stash recently crossed $1 billion, bolstered by the cryptocurrency’s price appreciation. BTC trades at $89,856 at press time, down 0.9% in the past 24 hours.

Featured Image from Unsplash.com, Chart from TradingView.com

Nepal’s Financial Intelligence Unit (FIU), in its Strategic Analysis Report 2024, revealed that the country’s blanket ban on crypto trading has become a significant obstacle for fraud victims seeking to report their cases to authorities.

Digital Asset Ecosystem In Nepal At A Glance

The FIU is a division of Nepal Rastra Bank, the country’s central bank. It monitors and reports suspicious transactions, particularly those linked to illicit activities such as money laundering and terrorism financing.

Related Reading: Nepal Issues Warning; Shuts Access To Crypto Gambling And Other Apps

The report highlighted an increase in fraudsters using techniques like “smurfing,” where large transactions are divided into smaller amounts to avoid detection. Additionally, these fraudsters convert illicit funds into digital currencies, making it harder for authorities to trace or freeze the assets.

The FIU further emphasized that many individuals are deceived into investing in digital assets with promises of extraordinary returns. The report noted:

The advertisements direct the potential prey to deposit amount in certain bank accounts or wallet accounts. The amount thus deposited is later not returned as promised. In countries like Nepal where investment in virtual assets like cryptocurrency is illegal, the victims rarely come up with complaints against such scams for potential repercussions.

Nepal banned digital asset trading and mining in September 2021. Subsequently, in January 2023, the Nepalese Telecommunications Authority ordered internet service providers (ISPs) to block access to all crypto-related websites, including trading platforms.

Social media and online advertisements are key channels through which fraudsters lure unsuspecting victims into fake digital asset investment schemes. However, the illegal status of digital asset trading in Nepal has discouraged victims from reporting these incidents to law enforcement, further enabling scammers.

The FIU has called for stricter oversight of crypto transactions in the country to curb these fraudulent activities. The report also underscored the importance of increasing public awareness, fostering inter-departmental cooperation, and creating a balanced regulatory framework to address crypto-related fraud more effectively.

Crypto Regulations In South Asia

Nepal is one of the few countries, alongside China, Russia, Iran, Bangladesh, and others, to ban all digital asset trading activity. However, other South Asian countries have adopted varying approaches toward digital assets.

Related Reading: India Cracks Down On Crypto: Regulators Favor CBDC In Push Vs. Bitcoin & Co.

For instance, digital asset trading is not outright banned in India. However, the country has imposed high tax on profits arising from crypto trades, without the option of using losses to minimize potential tax liabilities.

In contrast, Pakistan recently took a significant regulatory turn by legalizing virtual assets, a radical departure from its earlier anti-crypto stance. However, analysts believe this policy shift primarily aims to introduce a central bank digital currency (CBDC) rather than fully embracing decentralized cryptocurrencies.

Bhutan is perhaps the most pro-crypto country in the region. The nation’s total BTC stash recently crossed $1 billion, bolstered by the cryptocurrency’s price appreciation. BTC trades at $89,856 at press time, down 0.9% in the past 24 hours.

Featured Image from Unsplash.com, Chart from TradingView.com