AI “wealth window” will close January 9, 2024

Sponsored

Hello. I'm James Altucher. I've been called a “genius investor” by my fans… And an “eccentric millionaire” by some others. I think it's because I make big predictions… That tend to come true. Today, I'm making my boldest prediction ever. Next-generation AI technology will create the first $100 TRILLION industry. And there could be trillions available to those investors who get in early. I put together this personal video [HERE]… Revealing the AI stocks I believe… Could turn as little as $10,000… Into $1 MILLION over the next few years. If you get in early, this one-time opportunity could… Potentially change your financial circumstances… For you, your family, and your heirs. Today, I want to show you how I believe… AI 2.0 will open a brief “wealth window”… That will slam shut January 9, 2024. If you've missed out on new tech opportunities before…. I urge you, do not ignore this message. HERE is everything you need now.

P.S. To show you I'm serious about helping you get in on this opportunity, I'm giving away one of my top 5 AI 2.0 stock picks – free. See my top 5 pick here now.

During the global financial crisis 15 years ago, Arbor Realty Trust (NYSE: ABR) eliminated its dividend.

As far as the Safety Net model is concerned, though, the statute of limitations has expired. Safety Net considers companies’ dividend activity over the past 10 years only. Anything beyond that is ancient history.

Arbor Realty began paying a dividend again in 2012 and has raised it every year since 2015. It has regained its status as a respectable member of dividend-paying society.

But does that make its 12.7% yield safe?

Arbor Realty is a mortgage real estate investment trust, or mortgage REIT, that lends money to owners and buyers of apartment buildings.

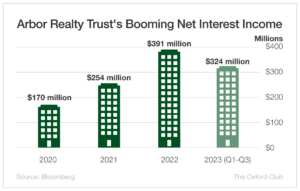

Last year, the company’s net interest income (NII), the measure of cash flow that we use for mortgage REITs, was up sharply from the previous two years. The $391 million total was 54% higher than the 2021 figure of $254 million and more than double 2020’s $170 million.

There are no official estimates for Arbor Realty’s NII in 2023 or 2024. But over the first three quarters of this year, it totaled $324 million, and it looks to be on pace to surpass $400 million for the full year.

The company paid out $282 million in dividends over the first three quarters of 2023, which gives it a payout ratio of 87%.

When it comes to REITs, I’m fine with a payout ratio of 100% or lower because REITs, by law, must pay at least 90% of their profits to shareholders in the form of dividends.

Over the past decade, Arbor Realty has an excellent dividend-paying (and dividend-raising) track record. Its payout ratio is reasonable, so the dividend appears safe.

The only question is… how safe?

Since there are no NII estimates available for 2023 or 2024, the next-best figure to use is revenue, which is forecast to decline by 4% from this year to next year. So I’m going to be just a little bit cautious with this one.

I’m not worried about a dividend cut in the next 12 months, but if 2024 turns out to be worse than expected, we’ll want to revisit this rating next year.

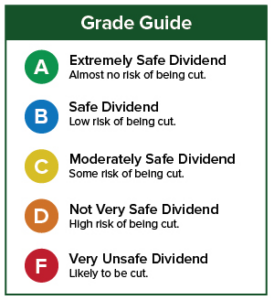

Dividend Safety Rating: B

#1 AI stock trading for $3

Sponsored

AI is by far the biggest tech investing trend of 2023. But Ross Givens says the #1 artificial intelligence stock is NOT Microsoft, Google, Amazon or Apple. Nope – his research is pointing to a tiny, under-the-radar stock that's trading for just $3 right now… And could soon shoot to the moon, handing early investors a windfall. This company already has 98 registered patents for cutting-edge voice and sound recognition technology… And has lined up major partnerships with Honda, Netflix, Pandora, Mercedes Benz and many, many others. So if you missed out on Microsoft when it first went public back in 1986… This could be your shot at redemption. Click here now for the full details of this $3 stock that's set to rocket in the AI revolution…