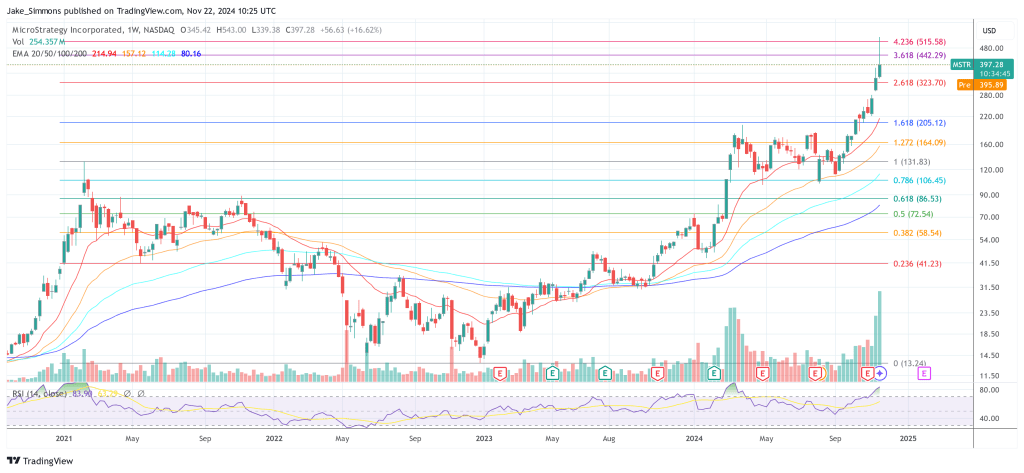

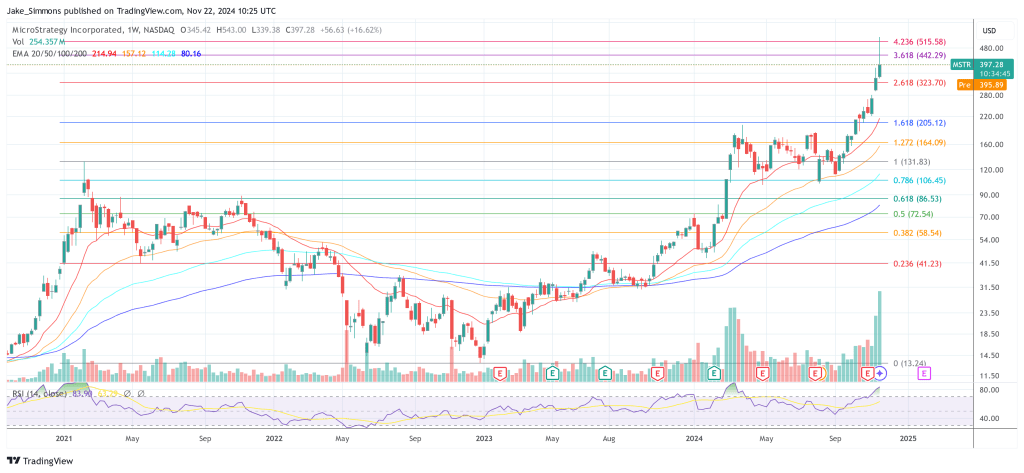

MicroStrategy Inc. (MSTR) experienced a sharp decline in its stock price yesterday, plummeting over 20% during intraday trading before closing down 16.2%. This significant drop occurred even as Bitcoin (BTC) surged to a new all-time high, just shy of $100,000. Despite the setback, MSTR remains up an impressive 479% year-to-date.

The stock’s tumble follows remarks from Andrew Left, founder of Citron Research, who expressed concerns about MicroStrategy’s valuation relative to Bitcoin fundamentals. “Now, with Bitcoin investing easier than ever (ETFs, COIN, HOOD), MSTR’s volume has completely detached from BTC fundamentals,” Left stated. “While Citron remains bullish on Bitcoin, we’ve hedged with a short MSTR position. Much respect to Michael Saylor, but even he must know MSTR is overheated.”

Contrasting Left’s bearish outlook, Charles Edwards, founder and CEO of crypto hedge fund Capriole Investments, offered a robust defense of MicroStrategy’s valuation. In an analysis shared on X, Edwards argued that the company’s current market capitalization and premium to its Bitcoin net asset value (NAV) are justified under certain conditions.

Related Reading: From Crypto To Corporate: MicroStrategy’s $26 Billion Bitcoin Bet Outpaces IBM’s And Nike’s

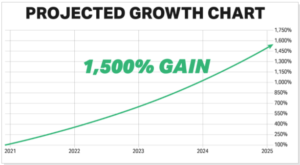

“Everyone thinks MicroStrategy is overvalued. It’s not,” Edwards stated. He suggested that if the current Bitcoin cycle mirrors the previous one—even under less favorable conditions—and if Saylor continues to aggressively acquire Bitcoin, then MicroStrategy has substantial growth potential. “Saylor needs to buy Bitcoin more aggressively the wider their NAV premium is. The 21/21 plan won’t do anymore as the market has already priced it in,” he noted.

Edwards emphasized the scale of recent capital raises, highlighting that “Saylor’s raised $9.6 billion in the last nine days alone.” He contended that with Bitcoin’s market capitalization poised to exceed $2 trillion, there’s a significant audience of bond traders who cannot directly access Bitcoin due to investment mandates. “The US bond market is $50 trillion—more than 25 times the size of Bitcoin. Today, MSTR is one of the only vehicles that gives bond traders exposure to Bitcoin,” Edwards explained. He added that MicroStrategy’s bond issues are “constantly oversubscribed,” displaying the strong demand for the MSTR stock.

Related Reading: Michael Saylor To Present Bitcoin Treasury Strategy To Microsoft Board

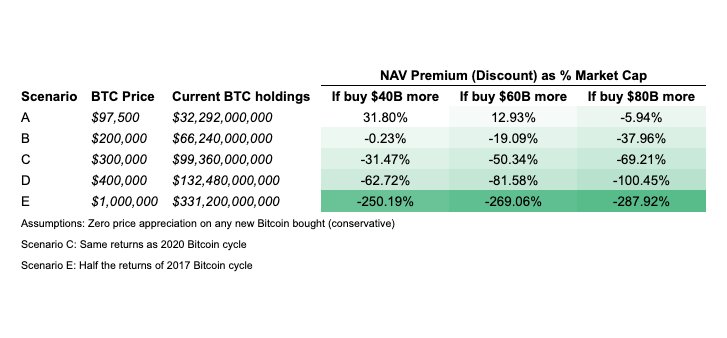

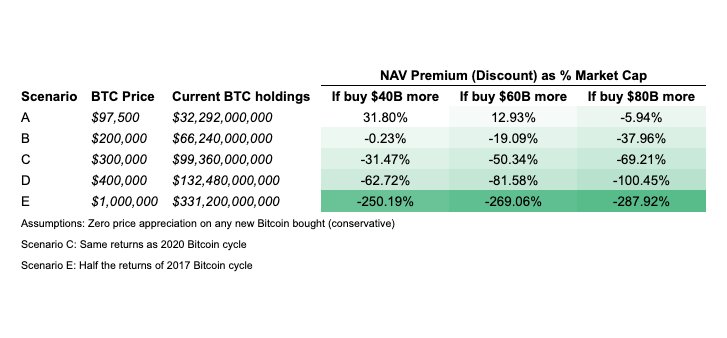

Addressing potential skepticism about his projections, Edwards clarified that his analysis is based on specific assumptions. “If you think Bitcoin is going to $200,000, and Saylor buys $40 billion more Bitcoin, then it can be considered ‘fairly’ priced today over the short term,” he said. However, he acknowledged that this scenario requires Saylor to be “much more aggressive than currently planned” in purchasing Bitcoin and that “there are many risks.”

Edwards also cautioned investors about the volatility of MicroStrategy’s NAV premium. “The NAV premia for MSTR fluctuates widely and aggressively. Don’t expect it to be stable with Bitcoin,” he warned. He stressed that his analysis is a “scenario analysis” and should not be used to predict daily returns, especially with speculative Bitcoin price targets like $1 million.

Concluding his insights, Edwards underscored the potential impact of MicroStrategy’s continued Bitcoin accumulation on the market. “Saylor needs to keep busy over the next year to actively close the premium by raising a lot more capital, but provided he does, there’s potential for MSTR equity yet,” he asserted. “Either way, we have a massive Bitcoin buyer in the market that is about to go into overdrive.”

At press time, MSTR traded at $395.89 pre-market.

Featured image created with DALL.E, chart from TradingView.com

MicroStrategy Inc. (MSTR) experienced a sharp decline in its stock price yesterday, plummeting over 20% during intraday trading before closing down 16.2%. This significant drop occurred even as Bitcoin (BTC) surged to a new all-time high, just shy of $100,000. Despite the setback, MSTR remains up an impressive 479% year-to-date.

The stock’s tumble follows remarks from Andrew Left, founder of Citron Research, who expressed concerns about MicroStrategy’s valuation relative to Bitcoin fundamentals. “Now, with Bitcoin investing easier than ever (ETFs, COIN, HOOD), MSTR’s volume has completely detached from BTC fundamentals,” Left stated. “While Citron remains bullish on Bitcoin, we’ve hedged with a short MSTR position. Much respect to Michael Saylor, but even he must know MSTR is overheated.”

Contrasting Left’s bearish outlook, Charles Edwards, founder and CEO of crypto hedge fund Capriole Investments, offered a robust defense of MicroStrategy’s valuation. In an analysis shared on X, Edwards argued that the company’s current market capitalization and premium to its Bitcoin net asset value (NAV) are justified under certain conditions.

Related Reading: From Crypto To Corporate: MicroStrategy’s $26 Billion Bitcoin Bet Outpaces IBM’s And Nike’s

“Everyone thinks MicroStrategy is overvalued. It’s not,” Edwards stated. He suggested that if the current Bitcoin cycle mirrors the previous one—even under less favorable conditions—and if Saylor continues to aggressively acquire Bitcoin, then MicroStrategy has substantial growth potential. “Saylor needs to buy Bitcoin more aggressively the wider their NAV premium is. The 21/21 plan won’t do anymore as the market has already priced it in,” he noted.

Edwards emphasized the scale of recent capital raises, highlighting that “Saylor’s raised $9.6 billion in the last nine days alone.” He contended that with Bitcoin’s market capitalization poised to exceed $2 trillion, there’s a significant audience of bond traders who cannot directly access Bitcoin due to investment mandates. “The US bond market is $50 trillion—more than 25 times the size of Bitcoin. Today, MSTR is one of the only vehicles that gives bond traders exposure to Bitcoin,” Edwards explained. He added that MicroStrategy’s bond issues are “constantly oversubscribed,” displaying the strong demand for the MSTR stock.

Related Reading: Michael Saylor To Present Bitcoin Treasury Strategy To Microsoft Board

Addressing potential skepticism about his projections, Edwards clarified that his analysis is based on specific assumptions. “If you think Bitcoin is going to $200,000, and Saylor buys $40 billion more Bitcoin, then it can be considered ‘fairly’ priced today over the short term,” he said. However, he acknowledged that this scenario requires Saylor to be “much more aggressive than currently planned” in purchasing Bitcoin and that “there are many risks.”

Edwards also cautioned investors about the volatility of MicroStrategy’s NAV premium. “The NAV premia for MSTR fluctuates widely and aggressively. Don’t expect it to be stable with Bitcoin,” he warned. He stressed that his analysis is a “scenario analysis” and should not be used to predict daily returns, especially with speculative Bitcoin price targets like $1 million.

Concluding his insights, Edwards underscored the potential impact of MicroStrategy’s continued Bitcoin accumulation on the market. “Saylor needs to keep busy over the next year to actively close the premium by raising a lot more capital, but provided he does, there’s potential for MSTR equity yet,” he asserted. “Either way, we have a massive Bitcoin buyer in the market that is about to go into overdrive.”

At press time, MSTR traded at $395.89 pre-market.

Featured image created with DALL.E, chart from TradingView.com