One tweet from Elon could blow this story wide open

Sponsored

Take a moment right now and unlock this shocking video. I just saw this from my friend, veteran Trader Tim Bohen. He says this video details a mega trading opportunity right now, that could blow up in the weeks to come.

In fact, he says, just one tweet from Elon Musk could blow this story wide open on or before April 17th. Click here to unlock this video now, before it's too late.

by Jody Chudley

The market is currently forecasting a sizable decrease in interest rates over the next couple of years.

Fed funds futures are projecting a 2-percentage-point decline between now and the end of 2025.

In this macro environment, the utilities sector should have a strong tailwind for the next two years.

Utilities are very sensitive to interest rates because they need to invest heavily in their capital-intensive operations (power plants, water infrastructure, etc.) and they use a significant amount of debt financing to do it.

Debt isn’t a huge problem for these companies, though, because their cash flow from operations is extremely reliable. Utilities generally have monopolies in their respective markets.

Now, the debt does cut into profits when interest rates are rising, because higher rates cause companies’ interest expense to increase. But the opposite is true when rates are falling: Interest expense goes down, and profits widen.

Additionally, when interest rates are lower and term deposits are less attractive, investors become more interested in the steady dividends utilities pay.

In March 2021, I recommended a power provider by the name of Vistra Corp. (NYSE: VST).

My bullish view on the company was not a result of the interest rate outlook in any way, shape or form. Interest rates were near 0% at the time, so they had nowhere to go but up.

What I saw in Vistra was an incredibly cheap, cash-generating business that the market had punished unfairly for a one-time hit to earnings.

Since then, the stock has done incredibly well despite the rise in interest rates.

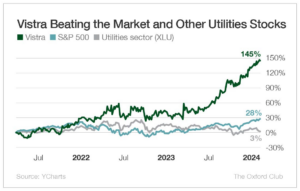

Vistra has returned 145%, versus 28% for the S&P 500 and just 3% for the Utilities Select Sector SPDR Fund (NYSE: XLU).

Readers who jumped on this trade won big!

But you may be wondering how Vistra’s valuation looks after this massive price increase.

The short answer is that I think Vistra’s stock still looks quite cheap.

Over the next several years, Vistra is expected to generate roughly $2 billion per year in free cash flow.

When we divide the company’s expected $2 billion in free cash flow by its enterprise value of $27 billion, we find that it is currently trading at a 7.4% free cash flow yield.

That is an attractive valuation, and I expect Vistra’s free cash flow to only increase over time.

Even better is what Vistra is doing with that free cash flow: aggressively returning it to shareholders.

Vistra currently has a dividend yield of 2.14%. The dividend will grow as free cash flow keeps growing. In fact, Vistra has nearly doubled its quarterly dividend over just the past four years.

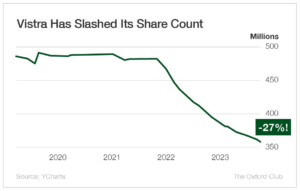

The company is also becoming more aggressive with share repurchases.

Its share count has dropped from 488 million to 357 million over the past two years.

That is an impressive share count decrease of 27%.

This kind of reduction in share count is extremely beneficial to shareholders when the stock is undervalued, which Vistra’s has been.

As the number of shares drops, each remaining shareholder owns a proportionately larger piece of the company.

I like the utilities sector for the next couple of years, and Vistra still represents excellent value within it.

The company has a strong free cash flow yield and solid growth ahead of it. It has been good to us in the past, and I believe it will continue to be.

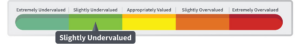

The Value Meter rates Vistra shares as being “Slightly Undervalued.”

The $3 AI ‘Wonder Stock' That Could Make You Up To 75X richer

Sponsored

THIS IS A VERY TIME-SENSITIVE OPPORTUNITY. You're so close to knowing the identity of what Ross Givens is calling the “$3 AI Wonder Stock”. This AI-related play could herald the single, biggest tech revolution of the 21st century. In fact, early indications show a $5,000 investment could realistically turn into $75,000… $20,000 could morph into half a million dollars. The WORST thing you could do is to miss out. Reveal the $3 AI ‘Wonder Stock' here.