$6 “AI Wonder Stock” Could Make You 75X Richer in 2024

Sponsored

THIS IS A VERY TIME-SENSITIVE OPPORTUNITY. You're so close to knowing the identity of what Ross Givens is calling the “$6 AI Wonder Stock”. This AI-related play could herald the single, biggest tech revolution of the 21st century. In fact, early indications show a $5,000 investment could realistically turn into $75,000… $20,000 could morph into half a million dollars. The WORST thing you could do is to miss out. Reveal the $6 AI ‘Wonder Stock' here.

Shares of app monetization company AppLovin (APP) soared 45.2% higher during February, according to data provided by S&P Global Market Intelligence. On Feb. 14, the company reported lovely financial results for the fourth quarter of 2023, solidly outpacing expectations on the top and bottom lines. This accounted for the majority of the gains for AppLovin stock during the month.

Prior to its earnings report, AppLovin's management had guided for Q4 revenue of $930 million at the most. But in Q4, the company generated revenue of $953 million, up 36% year over year and far ahead of expectations.

It's not just that AppLovin beat expectations; it's how it did it. The company largely generates revenue from its software business that helps app companies grow and monetize their users. The software is powered by the new version of its artificial intelligence (AI) software.

AI stocks are the hottest on the stock market right now. AppLovin's outperformance in Q4 demonstrated that it too is a top AI stock, which is why its jump higher was so pronounced.

A surprisingly great year for AppLovin

As of this writing, AppLovin stock is up 500% from the start of 2023 — remarkable returns over the last 14 months. Investors previously questioned whether the company could truly grow its software revenue as the app economy cooled down and its peers struggled.

It's safe to say AppLovin has answered its doubters. In 2020, the company had software revenue of just $207 million. In 2023, it had software revenue of over $1.8 billion.

AppLovin also generates revenue from first-party apps. But this isn't the focus of the company. The focus is on software. And the benefit of software is that it's high margin.

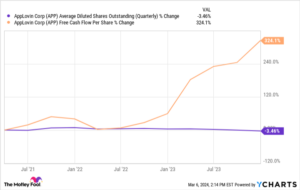

In 2023, AppLovin had free cash flow of $1 billion — quite good for a company with a market cap of just $22 billion as of this writing. And management has used some of the profits to repurchase shares. This means that AppLovin's per-share free-cash-flow growth has been great, as the three-year chart below shows.

What's next for AppLovin

For the first quarter of 2024, AppLovin expects to generate revenue of $955 million to $975 million, which would represent 34% to 36% year-over-year growth. However, because AI is driving growth in its software business, higher-margin software revenue is increasingly accounting for a larger share of the mix.

Therefore, AppLovin expects at least a 50% margin for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) compared to a 38% margin in the prior-year period.

With ongoing revenue growth and margin expansion, things still look good for AppLovin and its shareholders as 2024 gets going.

Sam Altman's Secret Plan to Take Down NVIDIA

Sponsored

A huge bombshell has emerged in the OpenAI saga with CEO Sam Altman… OpenAI, the startup behind ChatGPT, recently witnessed a whirlwind of events surrounding Altman. In just five short days, he was dismissed by the board, hired by Microsoft, and then reinstated as the head of OpenAI. However, Bloomberg reports that prior to his departure from OpenAI, Altman was actively seeking to secure billions in funding for a brand new startup company… A secretive venture codenamed “Project Tigris.” “Project Tigris” is NOT focused on developing a new app or another version of ChatGPT. Its mission, spearheaded by Altman, revolves around the creation of a chip company… One that's poised to rival Nvidia, the chipmaker now worth over $1 trillion thanks to the AI boom. You see, Nvidia's chips were originally designed to serve just one purpose… To create ultra-realistic graphics in games such as Call of Duty and Counter-Strike. In other words… Nvidia's technology was never meant to power AI. Sam Altman's vision involves producing chips specifically designed to handle high-volume AI workloads. And are also cheaper than Nvidia's. In short, this was Sam Altman's Plan to Take Down Nvidia… However, what many investors might not be aware of is the emergence of a little-known company poised to achieve what Altman could not… This firm has beaten Altman to the punch with a patent-protected chip specifically designed to run AI on. This makes it much more powerful than Nvidia's tech, which was originally designed for video gaming. This chip boasts a 100x performance boost. The U.S. Air Force, Cisco, and Raytheon are just some of this firm's early elite clients. But soon this chip will be available to the mainstream… And if you position yourself before it reaches the mass market, you could turn every $1 into $120… Just like early Nvidia investors did. I just published an urgent presentation on this unique opportunity. Inside, I'll explain all the details and how you can position yourself today. Get the full story here while there's still time.