Altucher: AI “wealth window” will close March 8, 2024

Sponsored

Hello. I'm James Altucher. I've been called a “genius investor” by my fans… And an “eccentric millionaire” by some others. I think it's because I make big predictions… That tend to come true. Today, I'm making my boldest prediction ever. Next-generation AI technology will create the first $100 TRILLION industry. And there could be trillions available to those investors who get in early. I put together this personal video [HERE]… Revealing the AI stocks I believe… Could turn as little as $10,000… Into $1 MILLION over the next few years. If you get in early, this one-time opportunity could… Potentially change your financial circumstances… For you, your family, and your heirs. Today, I want to show you how I believe… AI 2.0 will open a brief “wealth window”… That will slam shut March 8, 2024. If you've missed out on new tech opportunities before…. I urge you, do not ignore this message. HERE is everything you need now.

P.S. To show you I'm serious about helping you get in on this opportunity, I'm giving away one of my top 5 AI 2.0 stock picks – free. See my top 5 picks here.

The eyes of the world are shifting once again within the oil sector.

For the last three decades, that gaze has been razor-focused on just one emerging economy: China.

I know what you’re thinking…

Isn’t the United States the largest oil consumer on the planet?

We are, by a healthy margin.

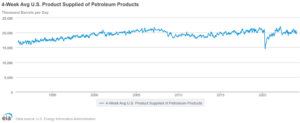

However, even though the U.S. consumes roughly one-fifth of the world’s oil, it’s also true that there isn’t much growth ahead. There hasn’t been much growth behind, either. In fact, our demand for petroleum products has been relatively flat for the last 24 years (with the exception of the COVID dip, of course).

Don’t take my word for it, just take a look for yourself:

The eyes of the world are shifting once again within the oil sector.

For the last three decades, that gaze has been razor-focused on just one emerging economy: China.

I know what you’re thinking…

Isn’t the United States the largest oil consumer on the planet?

We are, by a healthy margin.

However, even though the U.S. consumes roughly one-fifth of the world’s oil, it’s also true that there isn’t much growth ahead. There hasn’t been much growth behind, either. In fact, our demand for petroleum products has been relatively flat for the last 24 years (with the exception of the COVID dip, of course).

Don’t take my word for it, just take a look for yourself:

us oil consumption

Truth is, nobody is really expecting U.S. oil demand to suddenly surge higher. Nobody is expecting it to really drop either. The EIA’s long-term projections expect U.S. petroleum and liquid fuels to drop only slightly between now and 2050.

But our ravenous demand for crude oil has always been taken as a given. Everyone knows our demand growth has flattened.

So for the last two decades, the spotlight has almost always been on China.

Why? Well, because the key to oil’s fundamentals is how we’ll meet growing demand.

Think about it…

Back in the 1990s, China was only consuming around two million barrels per day; hardly a drop in the bucket compared to us. Slowly but surely, Chinese demand grew.

Over the next decade, China’s thirst for crude had nearly tripled. They couldn’t get enough as demand soared to 14.7 million barrels per day during the first half of 2023. That’s 8% higher year-over-year!

Make no mistake, China was under the spotlight last year more than ever before because the mainstream narrative was that its economy — and by proxy its oil consumption — would crash.

And yet, it didn’t.

Even the eternally-bearish IEA estimates that Chinese oil demand averaged around 17 million barrels per day in 2023 — a growth of nearly 4%.

With more growth on the way in 2024, you’d expect the spotlight to stay on China, right?

Think again.

Soon, the biggest driver for global oil demand growth won’t be China or the United States.

It’s going to be India.

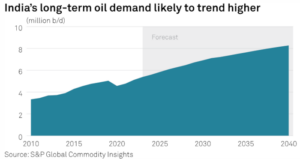

Fueled by cheap Russian crude — for which we can thank ineffective oil sanctions — India’s thirst for oil has grown in the post-COVID era, and is about to dethrone China as the largest source for global oil demand growth between now and 2030:

According to the EIA, India’s demand is expected to reach 6.6 million barrels per day over the next six years, and the country is planning to add another million barrels per day of refining capacity.

Of course, the first question that should pop into your head is where all of this new supply will come from.

Here’s a hint: The countries that end up feeding China and India’s future oil will end up with far more control over global oil prices.

More importantly, a new world oil order will emerge.

Millionaires will be minted OVERNIGHT

Sponsored

Legendary tech futurist who predicted the rise of Amazon, Netflix, and Apple YEARS in advance now says: “The biggest, most profitable technological advances in the future will ALL stem from this single breakthrough. Millionaires will be minted overnight.” He's revealing EVERYTHING here.