8,788% Return Predicted for THIS Crypto (already up 40% in 6 months)

Sponsored

THIS cryptocurrency has gained 40% in 6 months. A crypto millionaire who has researched the space for a decade says it will go up 8,788% in 5 years. The name of this cryptocurrency is revealed right here: >>Name of cryptocurrency<<

There’s no hotter topic in tech these days than artificial intelligence (AI). And when it comes to the proverbial “picks and shovels” enabling the AI gold rush, all roads lead to Nvidia (Nasdaq: NVDA).

The graphics-chip pioneer has reinvented itself as the undisputed leader in accelerated computing, and its cutting-edge software and processors power everything from autonomous vehicles to ChatGPT to drug discovery.

Naturally, that’s sent Nvidia’s stock skyrocketing in recent years. In fact, since the start of 2023, shares have surged more than 500%.’

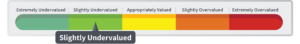

With the stock trading at such sky-high prices, you could be forgiven for thinking the company is too richly valued to be considered a bargain. But the results of our Value Meter analysis might surprise you.

Based on its enterprise value-to-net asset value (EV/NAV) ratio alone, it’s quite clear that Nvidia trades at a lofty premium to the broader market. The company’s EV/NAV of 58 is about nine times richer than the average of 6.4 for companies with positive net assets.

However, there are compelling reasons investors are betting that Nvidia’s growth will continue to significantly outpace the overall market. The company’s latest financial results speak for themselves.

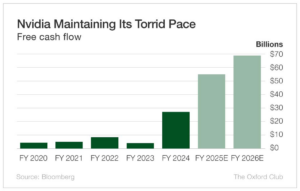

In Q4, Nvidia’s revenue skyrocketed 265% year over year to $22.1 billion, driven by a jaw-dropping 409% increase in data center sales. For the full 2024 fiscal year, which ended in January, revenue more than doubled to $60.9 billion, and the company generated an impressive $26.9 billion in free cash flow.

Over the past four quarters, Nvidia’s free cash flow averaged nearly 22% of its net assets. To put that in perspective, the average among companies with four straight quarters of positive free cash flow (which Nvidia has) is just 8.7%.

In other words, Nvidia is a veritable cash machine compared with most of corporate America.

What’s driving these exceptional results? In a word, innovation.

Nvidia invented the graphics processing unit (GPU) back in 1999. While GPUs were originally designed to power video game graphics, they also happen to be incredibly well suited for the massive computational power required by AI applications. Nvidia recognized this potential early on and has been aggressively tailoring its chips and software to more advanced AI models.

As a result, Nvidia’s data center revenue, driven largely by AI workloads, has exploded from the equivalent of a rounding error to a massive sum of $47.5 billion in fiscal 2024, more than tripling year over year and becoming the largest slice of the company’s revenue.

And Nvidia is just getting started.

Management sees the AI momentum continuing in the near term, guiding for roughly 8.6% sequential revenue growth in Q1. CEO Jensen Huang believes the ongoing shift from general-purpose processors to Nvidia’s accelerated computing platform will expand the company’s addressable market by trillions of dollars in the coming years.

(That’s trillions with a “T.”)

Of course, Nvidia does face competition from rivals like Advanced Micro Devices (Nasdaq: AMD) and Intel (Nasdaq: INTC). But the company’s entrenched ecosystem and rapid pace of innovation give it a strong competitive moat.

So while its valuation is certainly rich, the company’s dominant competitive position, explosive growth and robust cash generation suggest it may well grow into its premium price tag. With the AI revolution still in its early innings, the company seems to have ample room to run.

The Value Meter rates Nvidia as “Slightly Undervalued.”

Will this create $15.7 trillion in new wealth?

Sponsored

AI 2.0 will create $15.7 trillion in new wealth. Are you one of the few people who will take advantage of the opportunity? Renowned AI expert and former hedge fund manager, James Altucher expects the AI 2.0 “Wealth Window” will close very soon, so you have to act fast. But Altucher says you're not gonna make money listening to the gurus online telling you to make chatbots…or some other way to make a million dollars. You're probably not gonna make money investing in chip companies or the companies building the chatbots either. The $15.7 trillion opportunity is going to come from the next generation of Artificial Intelligence. This is about to create the biggest wealth building opportunity US history. And right now, according to Altucher, a rare “Wealth Window” is open that will allow everyday folks to get in on this $15.7 Trillion AI superboom. Look, this situation is developing incredibly fast. That's why he wants to give you a blueprint for investing in A.I. 2.0: his three best strategies for getting in on this technology superboom. He explains everything in a short presentation he just released. It's free to watch, and it includes everything you need to know about this once in a lifetime “wealth window. Take a few moments to watch it for yourself by clicking right here. But remember… and I can't stress this enough… This “Wealth window” will only be open for a brief moment. So don't wait. Click here now to watch his free video with all the details.